Trash and Treasure: The Unnatural Resource of E-Waste

As mountains of e-waste grow, so does the untapped potential of billions in precious metals and critical materials. Transforming this electronic trash into treasure could revolutionize industries and significantly reduce pollution and carbon emissions.

In 2022, the global economy produced 62 million metric tons of e-waste. If all of the valuable minerals, metals and reusable components could be instantly retrieved from the waste stream they would become one of the most valuable sources of high value raw materials. But in 2022 only 22.3% was recycled. Instead, most of an estimated $91 billion worth of copper, gold, and iron and other substances was lost to waste disposal. Also lost was the opportunity to annually reduce approximately 93 million tonnes of CO2 emissions by using recycled materials. One of the revolutionary narratives in world trade in this century will be the growing importance of e-waste management in the value equation and in addressing climate change.

The Growing Challenge and Economic Opportunities of E-Waste

With each technological advance, each product upgrade, and each uptick of tech demand the e-waste stream surges. 62 million metric tons were produced in 2022. Discarded smartphones, tablets, and computers contain concentrated hazardous materials including lead and mercury that find their way into soil and water supplies. In 2023, official reported cases of soil contamination numbered 4600 and water contamination reached 3300. There were 210,000 incidents of health issues and toxicity from people living near dumps whose only income is extracting valuable e-waste by hand. On humanitarian grounds alone there is an urgent need for supervised and regulated recycling practices.

Despite these challenges, e-waste presents substantial economic opportunities. The global e-waste stream in 2022 might have delivered $19 billion worth of copper, $15 billion worth of gold, and $16 billion worth of iron. Upgrading e-waste recycling can unlock significant economic value and take pressure off traditional tech supply chains. Countries can rebalance trade by exchanging high value recycled e-waste for tech products or even developing domestic manufacturing to diminish risks from geopolitical tensions and supply disruptions.

Trade Data Analysis of E-Waste Value Chain

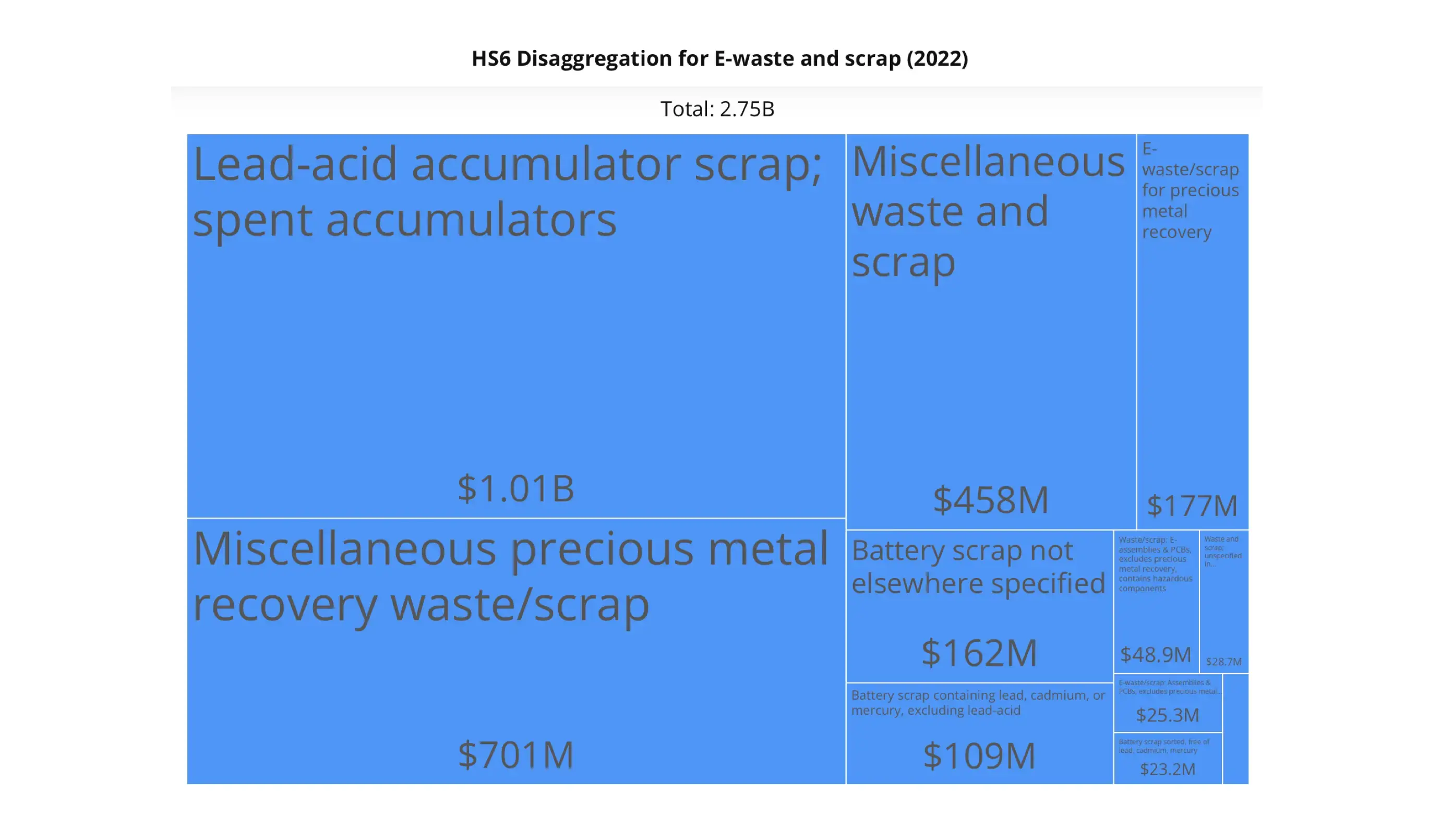

The 2022 revision brought e-waste into trade data with specific codes for e-waste products categorizing electronic waste based on material composition and origin. Lead-acid accumulator scrap originates from automotive and industrial batteries, while battery scrap with lead, cadmium, or mercury comes from older rechargeable batteries in laptops and power tools. Modern rechargeable batteries like lithium-ion are found in smartphones, tablets, and laptops. Precious metal recovery e-waste includes circuit boards and connectors containing gold and silver. Cancer causing PCBs are found in smartphones and computers along with mercury switches and toxic spent batteries. Hazardous component waste from older electronics is also categorized and there is an enormous range of waste coded “miscellaneous” denoting the diversity of e-waste.

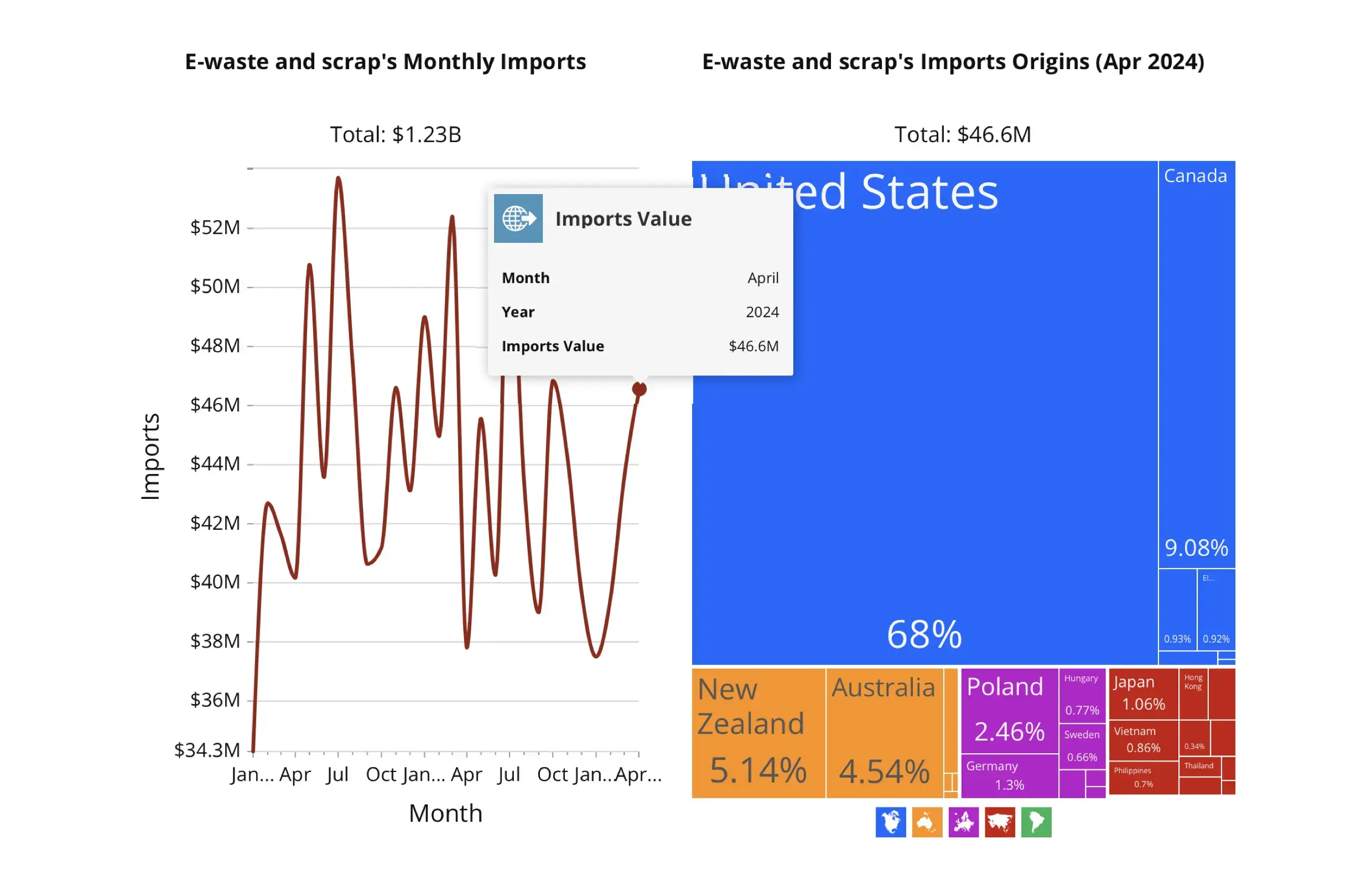

The Great American Throw-Away

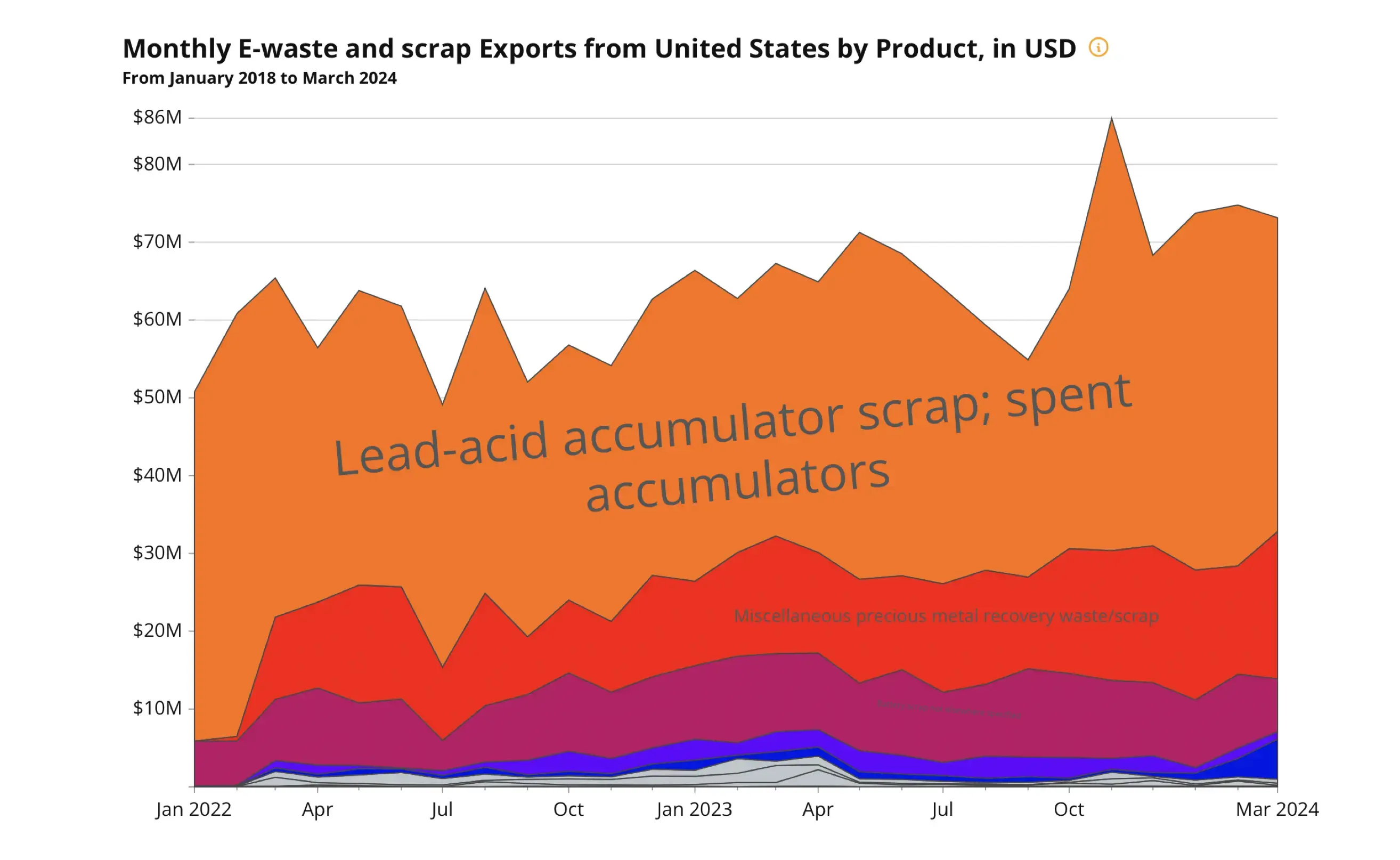

The United States is by far the top e-waste exporter. Lead-acid accumulators comprise 53% of e-waste exports primarily from larger batteries used in vehicles (cars, motorcycles), backup power supplies (UPS systems), and industrial machinery. Circuit boards, connectors, and other components containing gold, silver, and platinum are the second-largest category. An 8.71% increase in e-waste exports from March 2023 to March 2024 reflects the rising global demand for these recyclable materials, particularly from South Korea, Mexico, and India.

- Location: San Marcos, Texas, USA

- Specialization: Recycling rare earth magnets from e-waste using a proprietary Magnet-to-Magnet process, significantly reducing environmental impact.

Japan’s Import Savvy

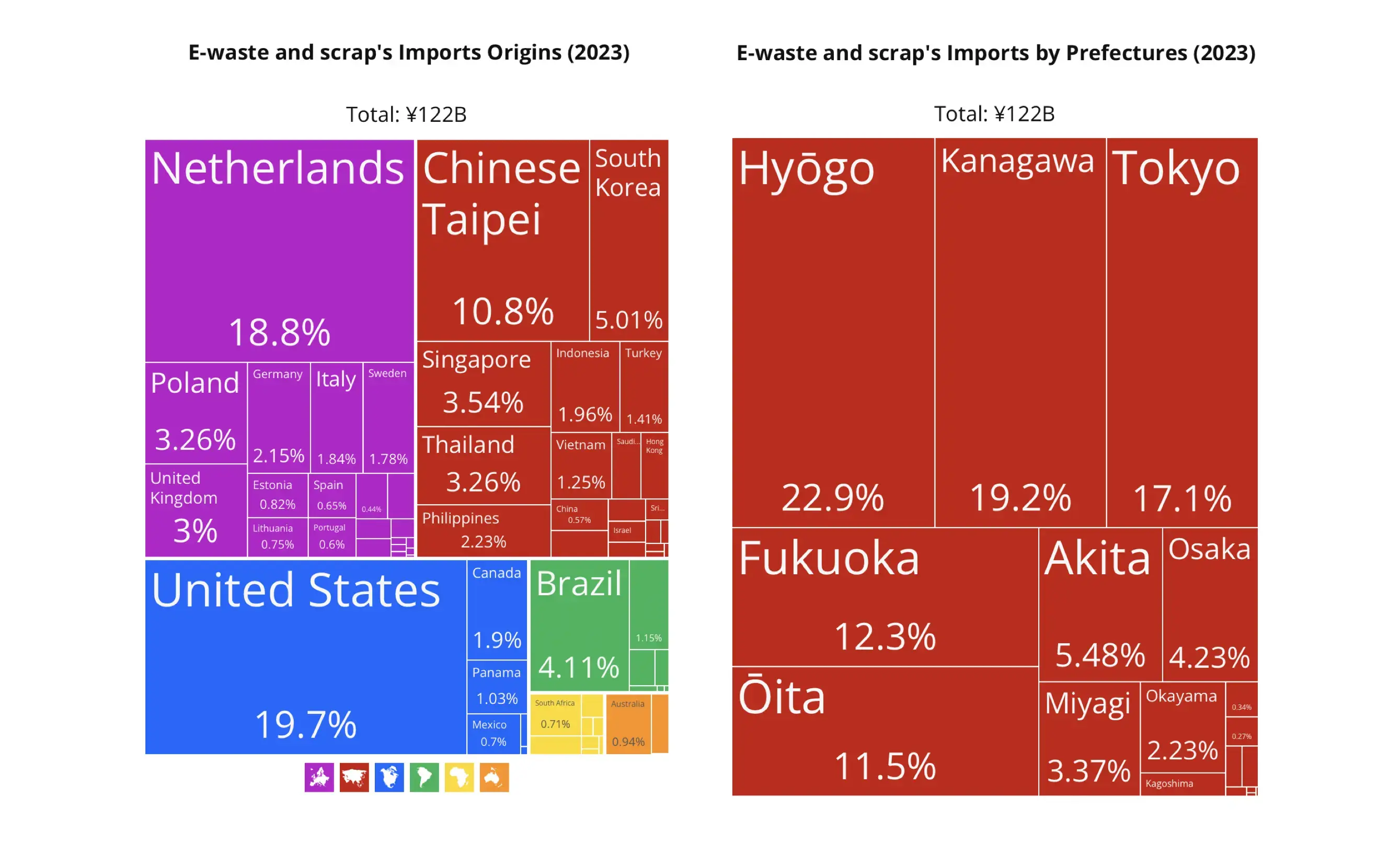

Japan is the leading destination for global e-waste. With a rapidly developing recycling capacity, imports have grown 5.19% from February to March 2024. 92% of Japan’s e-waste imports are coded: “Miscellaneous” out of which precious metals are extracted from sources in the United States, the Netherlands, and Taiwan.

- Location: Naoshima, Japan

- Specialization: Recovery of precious and rare metals from electronic waste, including metals from circuit boards and other electronic components.

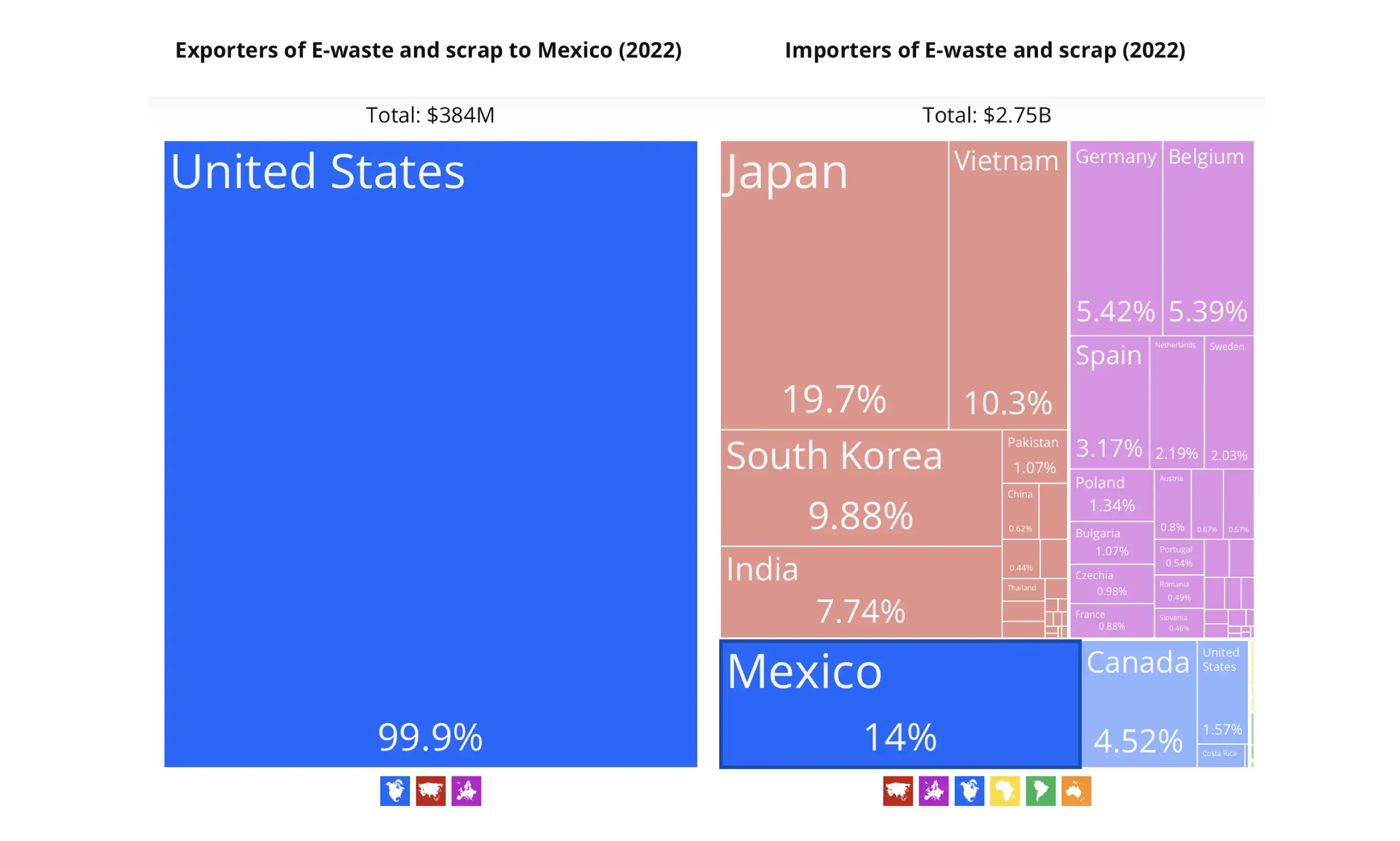

Growing Opportunities in Mexico’s E-Waste Trade

Mexico's e-waste recycling industry is poised for growth with lots of upside. In 2023, the country generated about 1 million tons of e-waste annually, with only 10% recycled on an industrial scale. Mexico is led by the companies ProAmbi, E-Global Recycling, and REMSA. These firms use advanced technologies to recover gold, silver, and copper from e-waste originating in the United States.

- Location: Monterrey, Nuevo León

- Specialization: ProAmbi focuses on the recycling of industrial and commercial electronic waste, managing collection, processing, and recovery of valuable materials.

South Korea’s Import Growth of Lead-Acid Accumulators

As of April 2024, South Korea had a remarkable 117% year-on-year increase in the import of lead-acid accumulator scrap to reuse the lead in its robust electronics and automotive industries, Seoul has deeply incentivized recycling and reuse of materials discouraging reliance on primary raw materials. South Korean policy rewards lower environmental impact, and economic sustainability.

- Location: Seoul, South Korea

- Specialization: KB Corporation focuses on the recycling of lead-acid batteries from automotive and industrial sources, as well as various rechargeable batteries like NiCd, NiMH, and Li-ion batteries

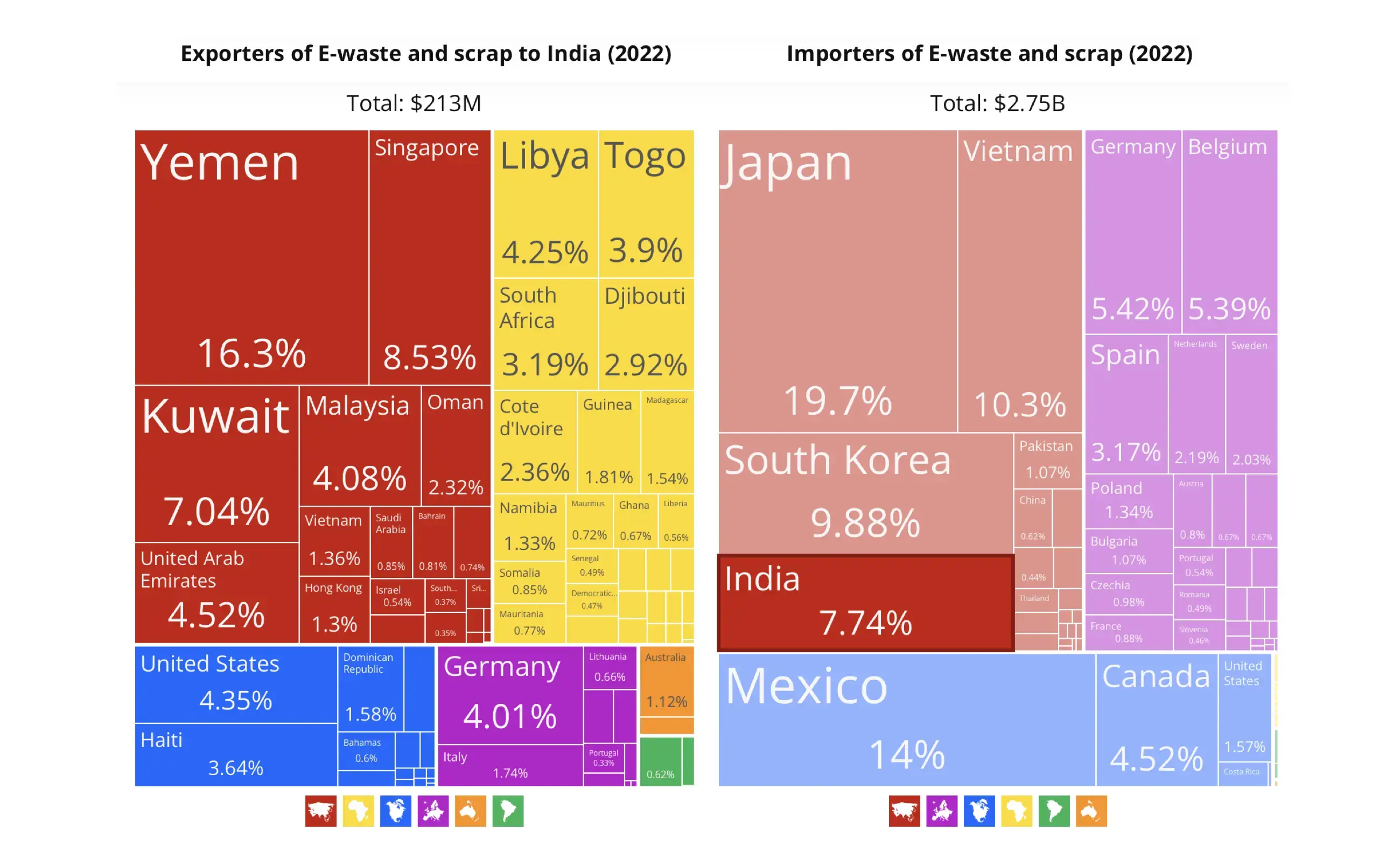

India's Booming E-Waste Recycling Industry: Innovations and Challenges

India's e-waste recycling industry is booming, driven by high electronic consumption and stringent environmental laws. Generating around 1 million tons of e-waste annually, the country hosts key players like Namo eWaste Management and Attero Recycling. India's low-cost industry has also captured e-waste imports from the Middle East and Africa. Despite challenges such as informal recycling practices, the sector's growth underscores India's potential to become a sustainable waste management powerhouse.

- Location: Faridabad, India

- Specialization: Namo focuses on the circular economy model, emphasizing recycling and reusing materials to create a closed-loop system. This approach reduces waste and conserves resources. The company processes over 100,000 metric tons of e-waste annually and aims to recycle materials back into the manufacturing process, thus minimizing the need for virgin resources.

Summary

Enhancing formal recycling processes and adopting consistent regulatory standards worldwide can significantly improve resource recovery rates and mitigate the environmental and health impacts of e-waste. Innovative leaders Noveon Magnetics, Mitsubishi Materials Corporation, ProAmbi, KB Corporation and Namo are well along on this path. Next steps for the global economy will be to develop recycling processes to give real and safe jobs to people who now live in toxic landfills. Global regulations are essential for better resource recovery and environmental protection to achieve the outcome of a more resilient global economy.