Jetstream Jigsaw: Does the complex assembly of the Boeing 737 Max compromise safety?

A mid-air failure, dramatic pilot heroics, a dead whistleblower, a widening investigation breaking all records for complexity, management shake ups, staggering cash outflows: the Boeing 737 Max exposes the huge built-in risk for aerospace supply chains.

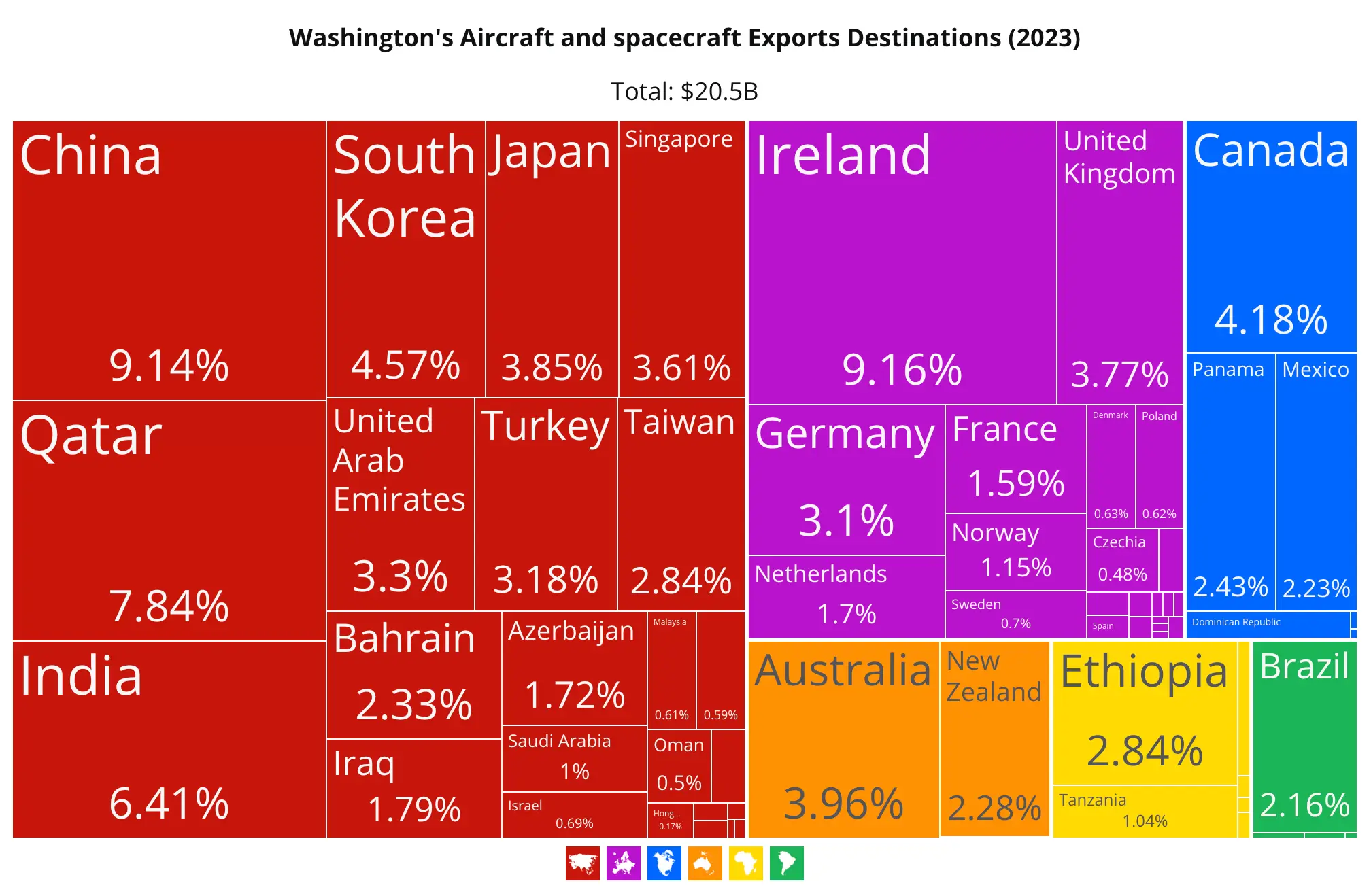

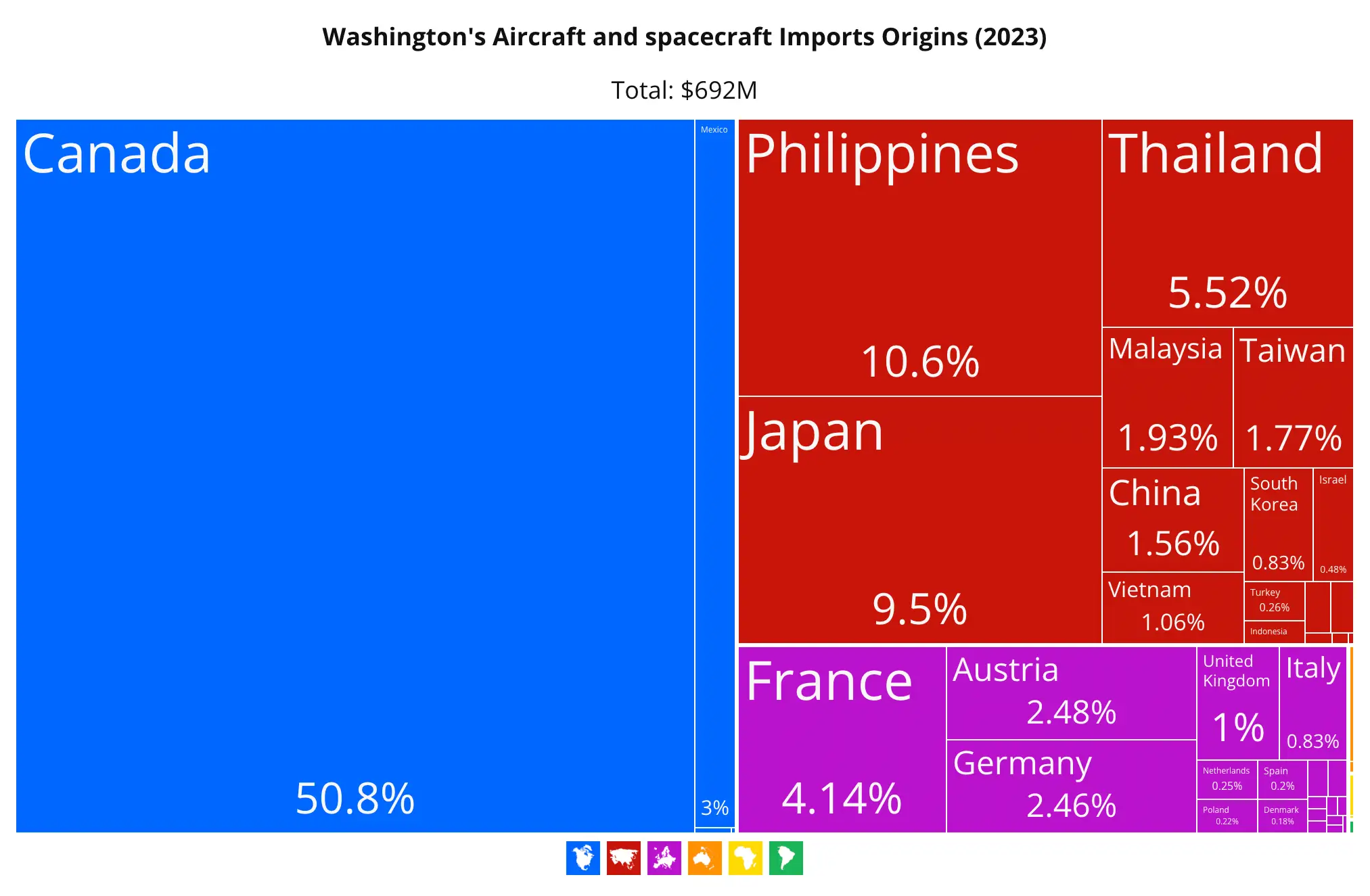

The Boeing 737 Max saga highlights a critical turning point for the aerospace giant, as passenger confidence wanes and its once unassailable reputation nosedives. Despite Boeing’s prominence in blending cutting-edge materials and digital technologies in manufacturing, the FAA’s investigation into the 737 Max’s door plug failure underscores the dilemma: Can Too Much Sophistication and Complexity Turn Innovation into a Safety Threat? Historically, Boeing not only pioneered aviation milestones but also represented a huge share of Washington State’s $61.1 billion in aerospace exports last year. However, the aviation industry’s dependance on safety and passenger confidence demands unparalleled redundancy, maintenance, and testing. With Boeing’s vast, global supply chain complexity does safety risk getting lost? 3 million parts per aircraft sourced from 65 countries means Boeing’s operational challenges are immense to serve 150 countries with Boeing jets. Our analysis, using U.S. Bill of Lading trade data, reveals the intricate balance Boeing navigates between innovation, safety, and supply chain management amidst FAA scrutiny.

Boeing’s Aerospace Lineage and Global Supply Chain

Every schoolchild in Seattle knows how Boeing’s industrial might and military planes helped tip the balance that won World War II. From those stories, Boeing has evolved beyond defense, beyond earth orbit to dominate commercial aviation for most of the era of flight to become a global manufacturing behemoth, leveraging international sourcing from across the globe. To achieve this, Boeing must maintain sensitive coordination and high-tech procurement from nations that compete with Boeing as well as trade with it. China, Japan, Italy, and many others reflect these unusual manufacturing demands in their relationship with Boeing.

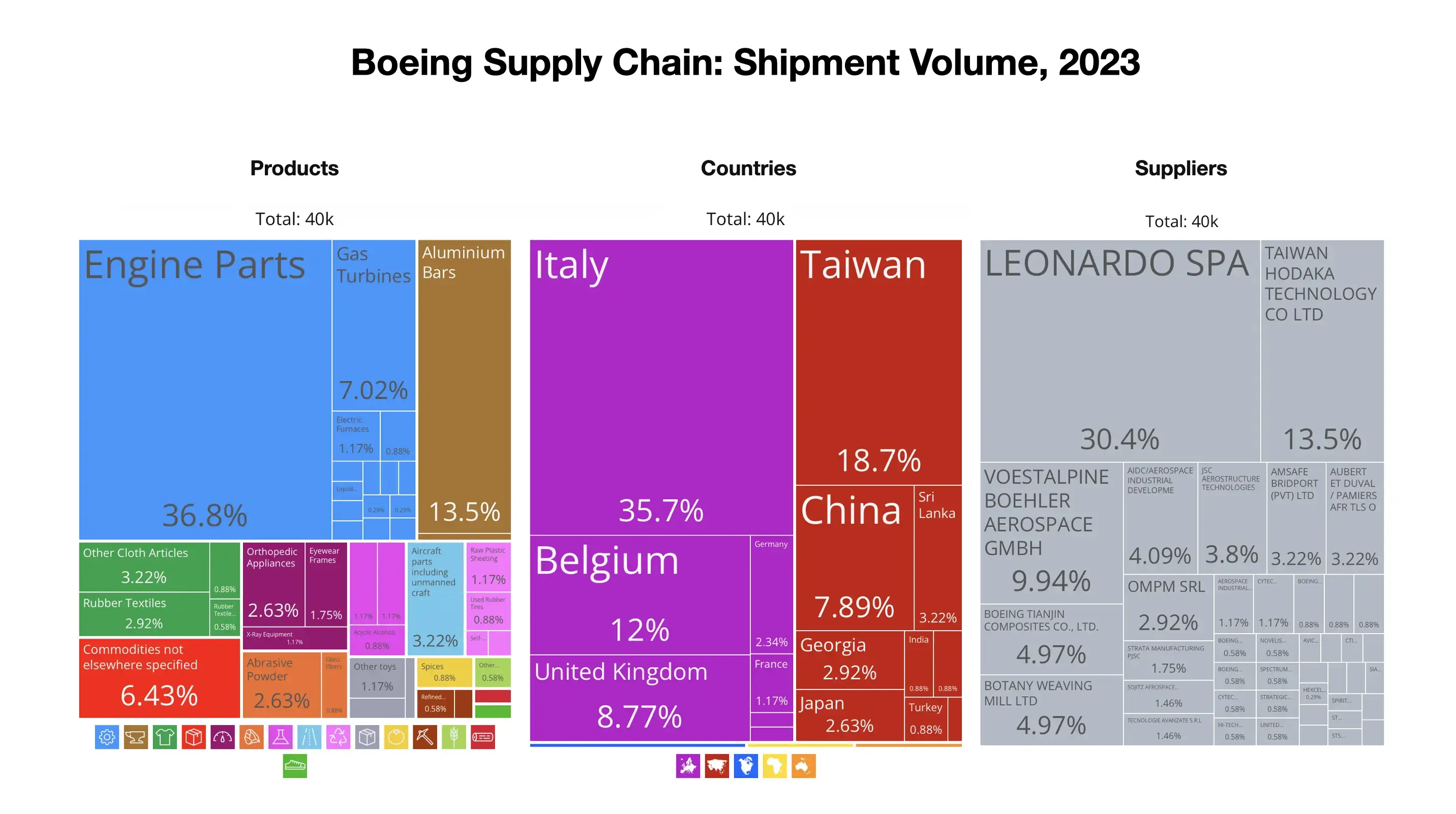

The company sources high-tech electronics and advanced composites from China, Japan, South Korea, Italy, Turkey, India, Austria, and Taiwan. Nuanced partnerships with the Japan Aircraft Development Corporation (JADC) and Leonardo S.p.A. highlight procurement and collaborative R&D challenges.

Who Gets What From Whom?

Here is a sketch based on Bill of Lading data showing the robust supply network that maintains Boeing’s leadership:

- European Titanium: Key for airframes and engines, the Netherlands exports to Boeing and Airbus a sign of unmatched European material expertise.

- Japanese Composites: The Japan Aerospace Development Corporation (JADC)'s contributions to the 787 Dreamliner.

- Structural Components: Spirit AeroSystems is just one of the partners supplying wings and fuselages.

- Electronics and Avionics: Rome based Leonardo S.p.A.'s vital navigational and operational systems are among the most complex pieces of the Boeing supply chain “Jigsaw Puzzle.”

- Logistical Strategy: Boeing infrastructure and facilities proximity to tech hubs in Pusan, South Korea, Osaka, Japan, and Shanghai is a key strategic component of the company’s approach to collaboration.

- Inventory Management: From small fasteners to large fuselage sections and sophisticated avionics this supply chain requires successful management of over 7 billion annual shipments. Central to the challenge for Boeing is determining if there is an upper limit to scalability in this industry.

Does the 737 Max Signal an Event Horizon for Supply Chain Scale

The Boeing 737 Max launch wasn’t only the demonstration of an aircraft. It was the test flight for a supply chain dependent on millions of outsourced components and deeply sensitive multinational collaborations.

- Horizontal Stabilizers: Shanghai Aircraft Manufacturing Company (SAMC), a subsidiary of the Commercial Aircraft Corporation of China (COMAC), provides the stabilizers that minimize turbulence in flight.

- Vertical Fins: The Aviation Industry Corporation of China (AVIC), a leading aerospace and defense conglomerate, supplies the essential vertical airfoil surfaces key to 737 Max's performance.

- Spoiler Kits and Flap Assemblies: Tech Aero from India, marking its entry in 2023, supplies most spoiler kits while AVIC continues delivering flight control flap assemblies.

- Landing Gear Components: Florida based LandingGearTech saw a 15% increase in shipments in Q3 2023 due to the 737 Max.

- Electrical System Components: South Africa Based ElectroComp is responsible for crucial electrical parts that upgrade the 737 Max.

- Aircraft Wing Forges: Precision Machine Works, Inc. just a short drive down Interstate 5 from Seattle supplies key precision components for aircraft wings,.

- Main Landing Gear Door Kits: The Aerospace Industrial Development Corporation in Taiwan (AIDC) is crucial for providing components that enhance aerodynamics and safety.

- Fuselage Components: Boeing Tianjin Composites, a joint venture between Boeing Co. and AVIC, focuses on fuselage sections.

- Winglets: GKN Aerospace, in the UK, specializes in winglets to improve fuel economy and reduce emissions, contributing significantly to the 737 Max's efficiency.

- Advanced Electronics and Avionics: Leonardo S.p.A. in Italy provides advanced electronics and avionics, as it does for much of the Boeing fleet..

- Engine Manufacturers: CFM International, a joint venture/partnership between GE Aviation and Safran Aircraft Engines, supply the LEAP-1B engines for the 737 Max.

Conclusion

To conclude with certainty the cause of aviation failures in our time requires some daunting detective work inside the Boeing 737 Max supply chain. Further, the intricate and far-flung global structure of the manufacturing process makes certification of airworthiness more challenging than ever. The delicate balance between extensive international collaboration and the risk of supply chain disruptions is an additional layer of complexity. The high profile January 5th 2024 door plug failure highlighted vulnerabilities miraculously without severe injury or death. The lucky outcome has become a clarion call for redesigning quality control strategies for complex supply chains of this magnitude.

Implementing advanced analytics and real-time monitoring tools supported by AI might upgrade Boeing’s view of its supply chain, improving transparency and swift identification of potential risks. The 737 Max’s safety is the test of an aircraft and the integrity and reliability of future aerospace ventures. Boeing is accustomed to being an aviation pioneer, but can it excel In facing the challenges of global supply chain management and ever more complex aircraft and manufacturing systems? The answer to this question may deliver a verdict on a legacy company and a 21st century industry.

For more information explore Boeing company report in the OEC.