Palladium, Catalytic Converters, and the Challenges of Economic Sanctions

A sharp increase in catalytic converter robberies to extract palladium highlights the far-reaching consequences of the Russian invasion and the intricate calculations of economic sanctions.

The email came late at night with the subject "Car part stolen." A neighbor, using google groups, wrote that someone had looted the catalytic converter from her Toyota Prius. Unfortunately, cases like hers are skyrocketing everywhere. The appeal is not the catalytic converters but the rare metal, palladium, inside them.

Palladium is a pricey metal expected to become even more scarce with the Russian invasion of Ukraine. Production shortages and rising demand had driven palladium prices for over a decade. However, uncertainty is now fuelling their rise to historic levels.

Catalytic converters help gas-powered cars reduce pollutants harmful to the environment. Palladium neutralizes toxic pollutants by turning them into water vapor and carbon dioxide. As we look for ways to reduce emissions from internal combustion engines, our demand for palladium has increased.

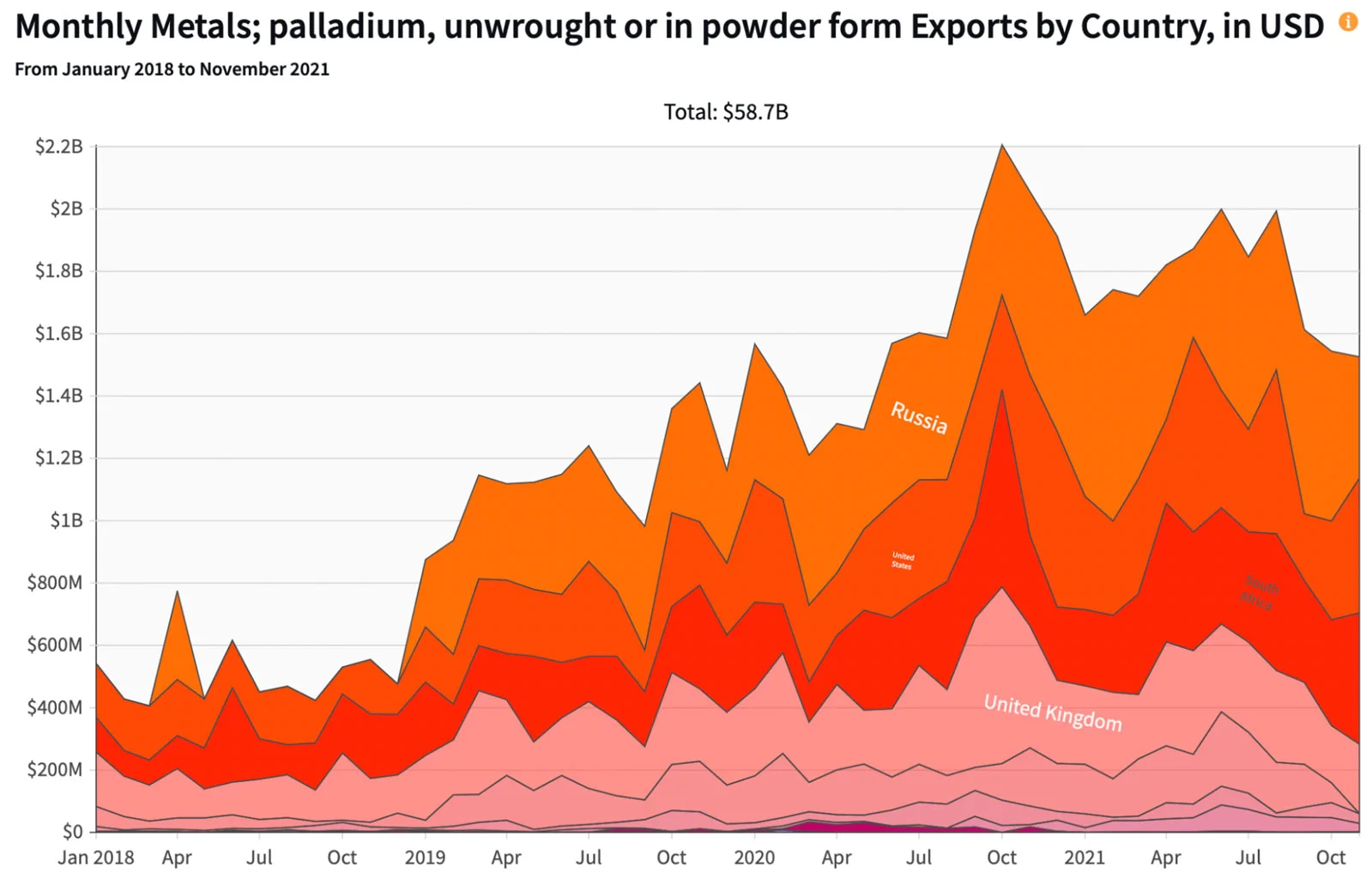

Russia accounts for a quarter of global palladium exports. In 2020, the top exporters of palladium were Russia ($6.47B), the U.S. ($3.67B), and South Africa ($3.26B). Between 2019 and 2020, palladium exports grew by 39.7%, from $18.1B to $25.3B.

In 2021, Russia exported $6.55B in palladium—including $1.58B to the U.S. With international sanctions disrupting Russia's exports, the world's largest producer, palladium prices have climbed to their highest level.

The day Vladimir Putin announced his decision to launch a "special military operation" in eastern Ukraine, palladium traded at $2,372 per troy ounce. Two weeks later, as the economic sanctions on Russia escalated, the price reached a historic high of $3,302 per troy ounce. Although the price has decreased in recent days, it will continue to be highly sensitive to changes in exports from Russia.

Palladium trade was in deficit before the invasion. Exports, measured in metric tons, have fallen as demand rises. In 2008, the world exported 564 metric tons. In 2020, it dropped to 400 metric tons, just as the demand for palladium increased. Producers aren't quick to respond to price changes because palladium is a byproduct. So, palladium price has grown six times in the last six years.

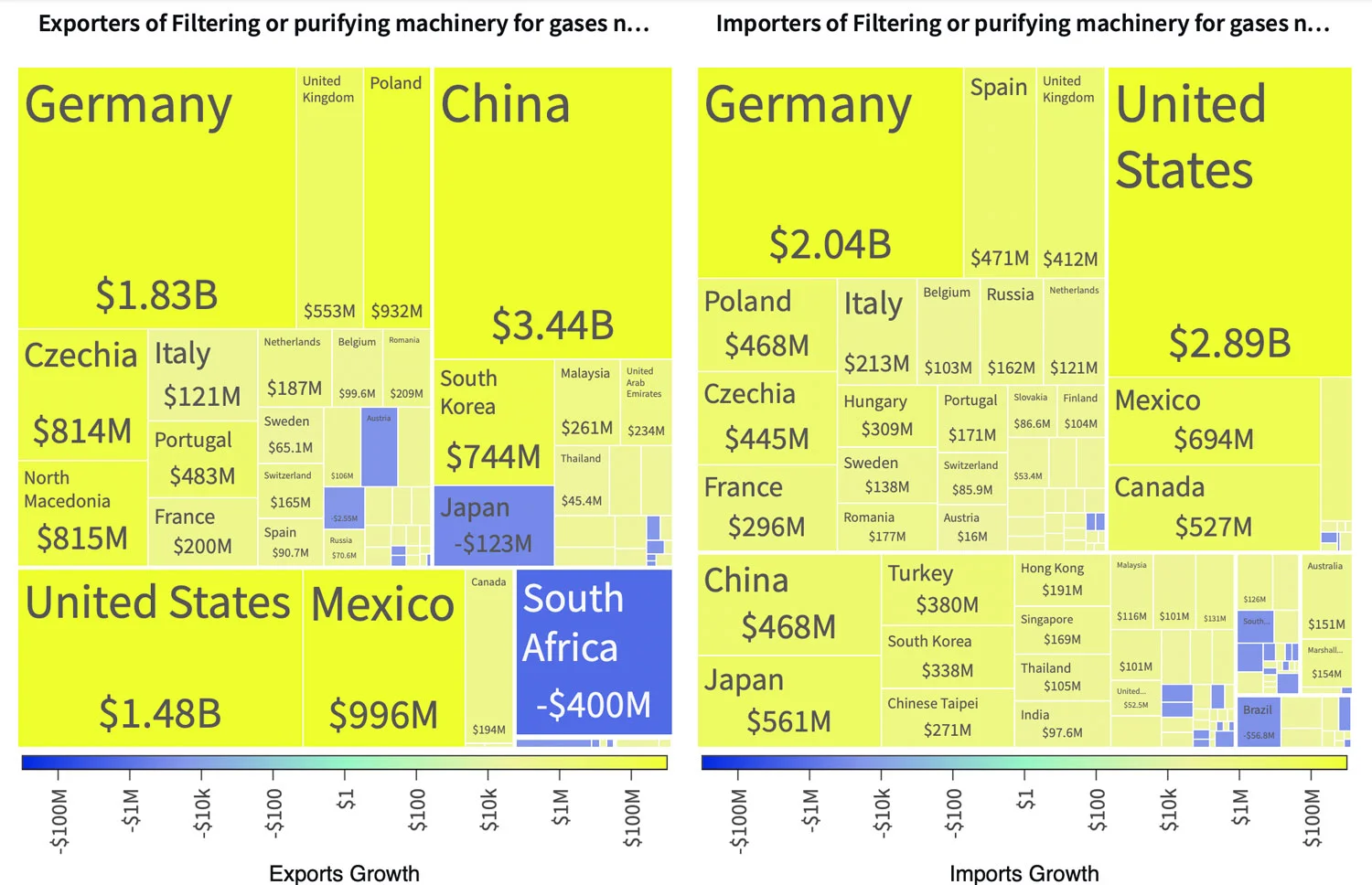

Demand for palladium has increased consistently—about 80% of palladium is used in catalytic converters, a pollution-control device for vehicles. As a critical component in reducing emissions in car combustion, catalytic converters passed from $12.8B in exports in 2010 to $27B in 2020, a 211% increase in one decade.

So far, the U.S. and NATO haven't banned palladium or other rare metals, underscoring the dilemma of sanctioning Russia without hurting access to critical commodities.

Financial and corporate sanctions, however, have made trading with Russia challenging. As a result, palladium prices jumped, making it unaffordable for some industries. In the case of automakers, palladium prices could speed up changes to more cost-effective metals, like rhodium, or increase palladium demand from South Africa. Rhodium prices, however, have raised more than 4.2K% over a decade.

As palladium prices soar, robberies of emissions-control devices increase. Although it can happen to any car, my neighbor's Toyota Prius is a more attractive target because hybrids need more palladium to work correctly. Unfortunately, a robber can bank as much as $700 per converter, leaving the car's owner with a $2,000 bill to replace it.

Perhaps, the question is not whether Russian metals are too big to sanction but whether our dependence on rare metals to achieve the so-called energy transition is too big to bear.