An Asian Elephant Works the Room: Monsoons, Modi, and Microchips

India's transition from traditional agriculture to a leader in global technology and manufacturing marks a notable economic transformation in the 21st century.

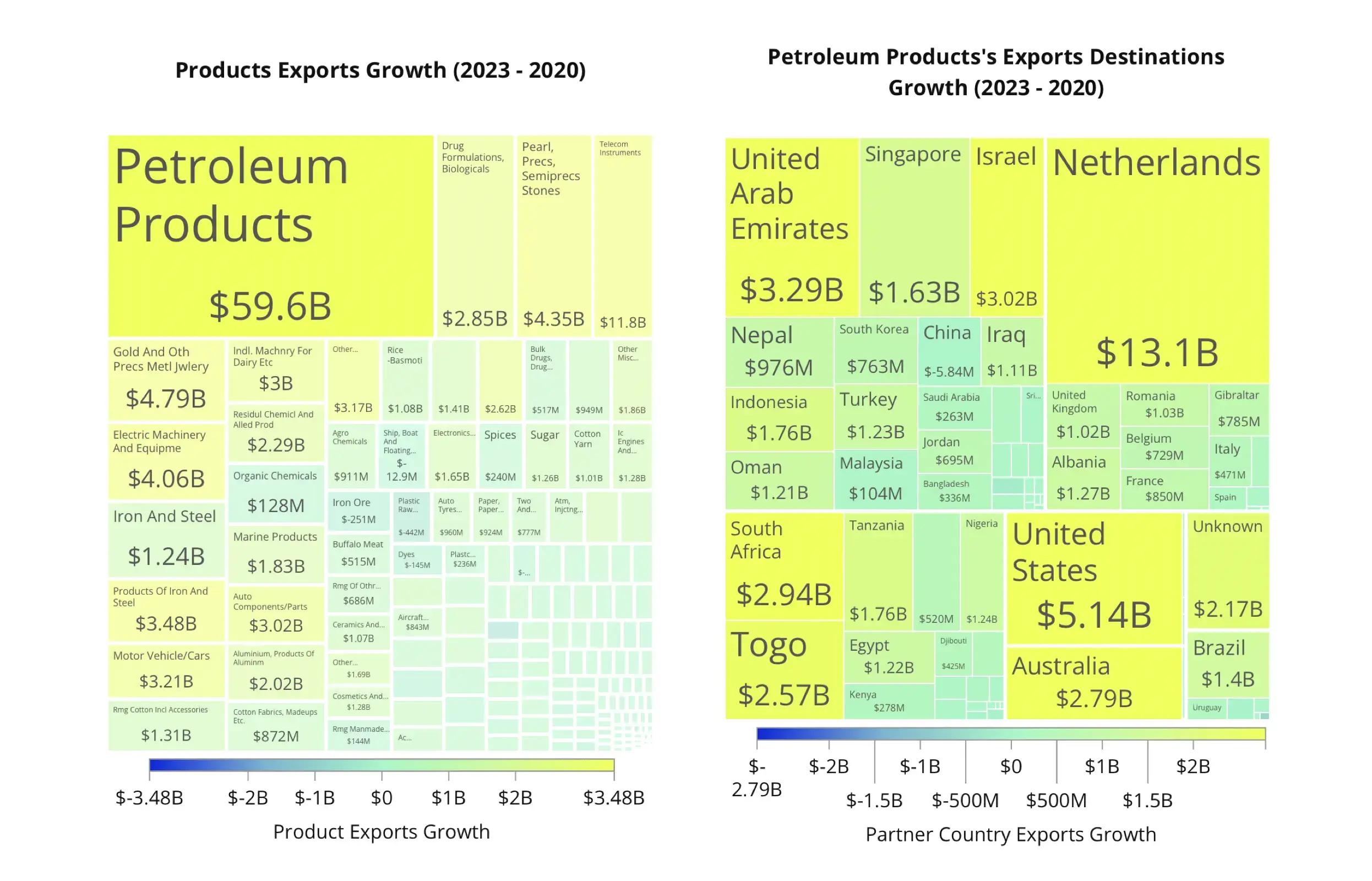

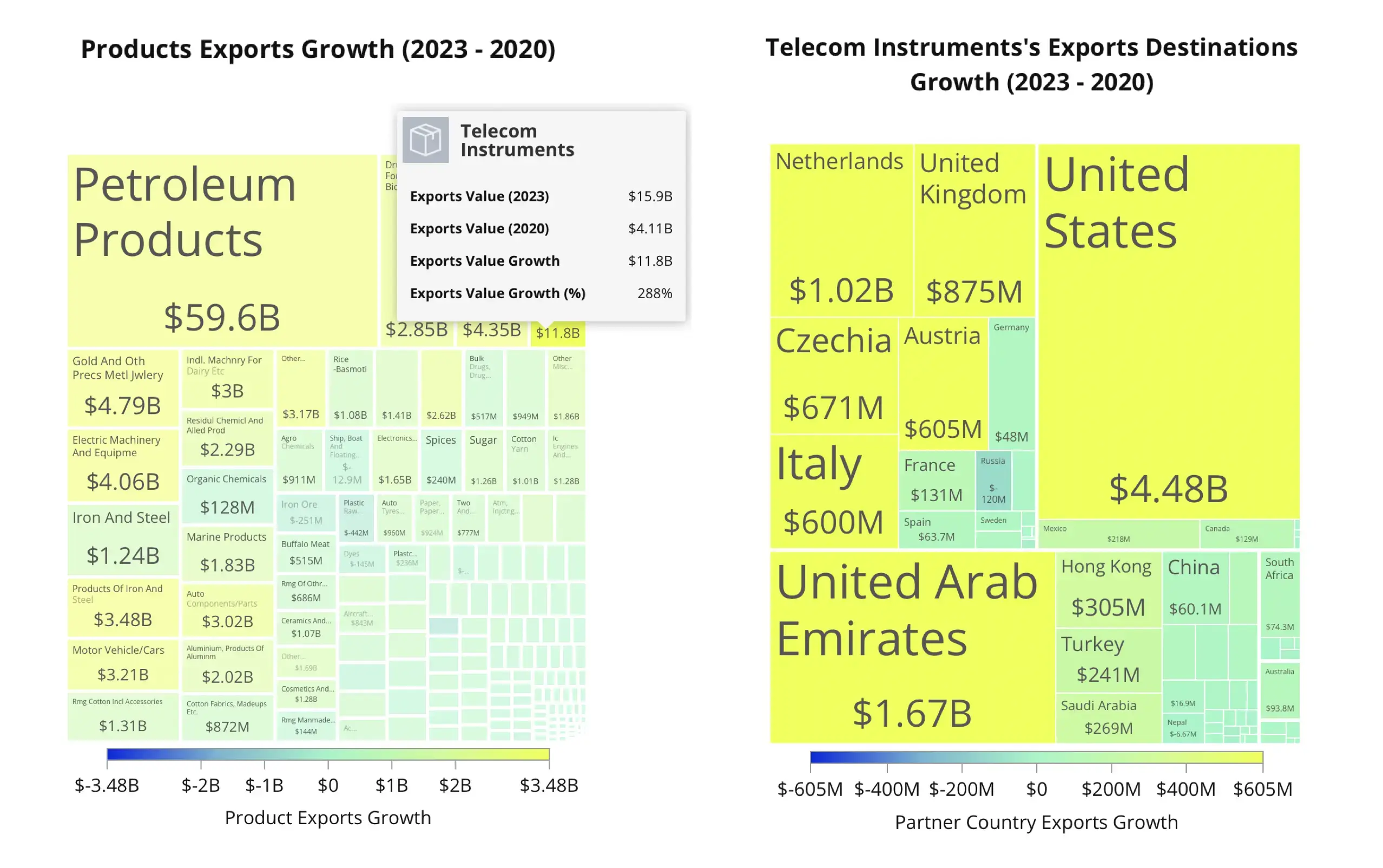

The trend seems to be accelerating. Since the COVID-19 pandemic, India’s export sector has grown from $275 billion in 2020 to $453 billion in 2022. A dual focus on strategically targeted commodities and high value tech and manufacturing is delivering growth in a challenging global trade environment. Although exports dipped by 1.2% in 2023, the first two months of 2024 actually set new records. Petroleum products accounted for 22% of total exports, while pharmaceuticals and mobile phones made up 4.4% and 3.8%, respectively. This marks a significant increase from early 2020. Exports of petroleum and mobile phones have tripled while India’s already strong pharmaceutical sector doubled exports during the same period.

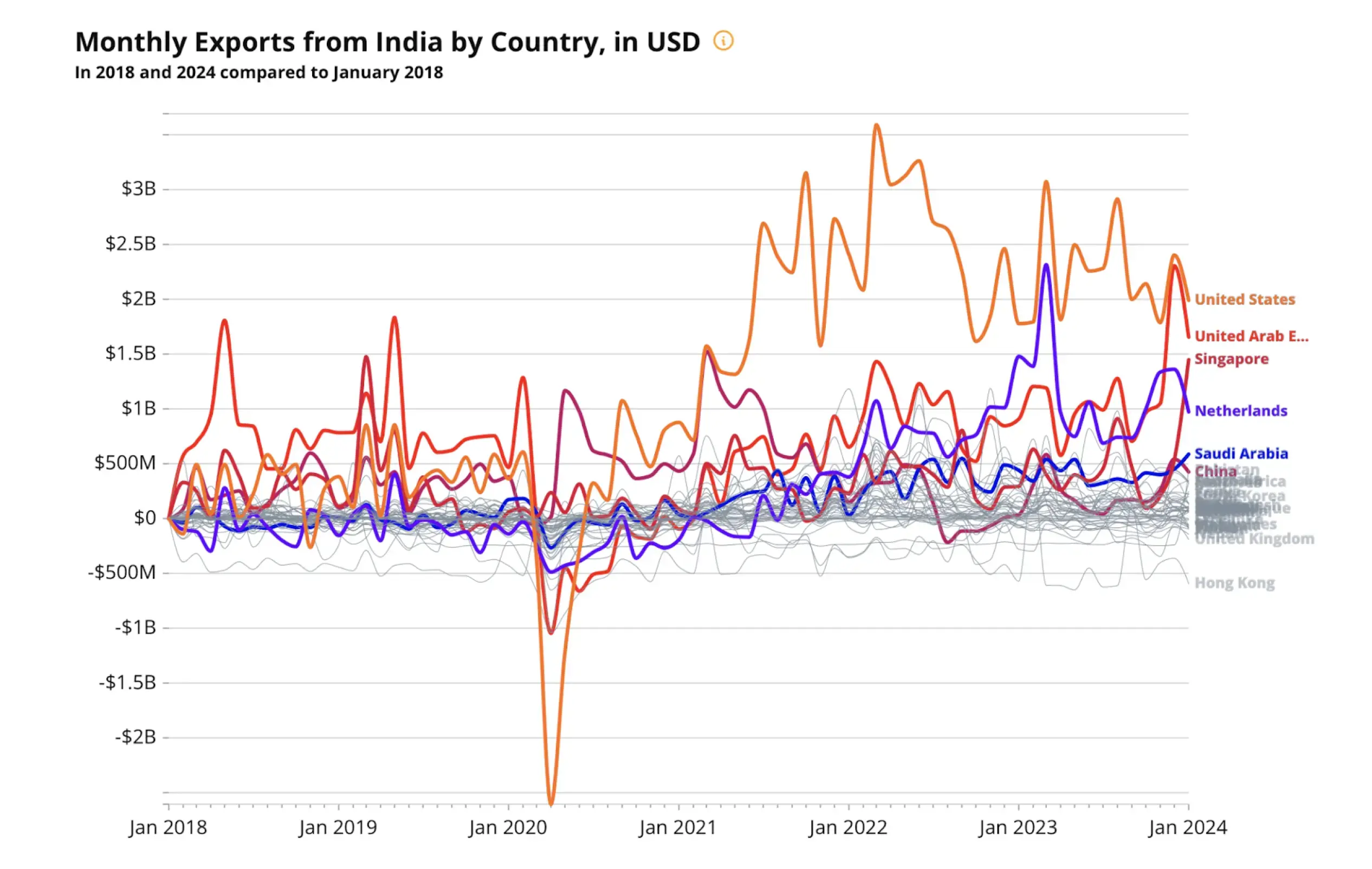

In this report we take a detailed look at India's export portfolio across key markets: the U.S., the UAE, Singapore, the Netherlands, Saudi Arabia and China. India’s high-tech strengths, especially in the U.S., are weighed against more vulnerable commodity markets, such as refined oil exports to the UAE and the Netherlands. India’s nimble sector shifts and quick strategic responses shows an economy well tooled for finding opportunities in coming decades.

Commodities: The Traditional Backbone

India’s commodity export portfolio, including refined oil, metals, and rice, has been significantly shaped by global geopolitical shifts. When the Ukraine conflict targeted Western sanctions on Russia, India greatly increased its imports of discounted Russian crude, making Russia its top supplier and boosting India’s role as an eager buyer in global oil markets. This strategic move delivered benefits on both sides of the balance sheet. India got a windfall of $7.17 billion in foreign exchange from discounted Russian crude between April 2022 and May 2023 and turned around and sold 115% more refined oil exports to Europe, with notable increases to the UAE, the Netherlands, and the United States at the same time.

The vulnerability of agricultural commodities was a costly reality in 2023 when the monsoons failed due to an El Niño event. Adverse weather wiped out 7 million metric tons of rice and the response from Delhi was rapid and precisely targeted. The government banned exports of non-Basmati white rice and imposed a 20% duty on parboiled rice exports to stabilize domestic prices. Nevertheless, prices remained stubbornly high, a reminder that weather-sensitive agricultural exports can quickly raise trade deficits and produce domestic instability.

The quick acting government of prime minister Narendra Modi, heavily favored in the middle of a crucial election at the moment, can only go so far to cushion India from the volatility of commodity exports. The need for India to drive toward diversification is undiminished. Look for continued public sector investment in innovation to broaden the country’s economic complexity.

Tech Products: The New Frontier

To the outside world the label may say: MADE IN INDIA, but the benchmark goal everywhere inside the country is growing high-tech exports, telecommunications, semiconductors, and aerospace technology, including drones. Companies across the country are embracing the directive: "Make in India". This initiative has drawn over $20 billion in global investments, significantly enhancing India's tech manufacturing capabilities. Mobile phone exports to the United States, the UAE and the Netherlands have experienced substantial growth.

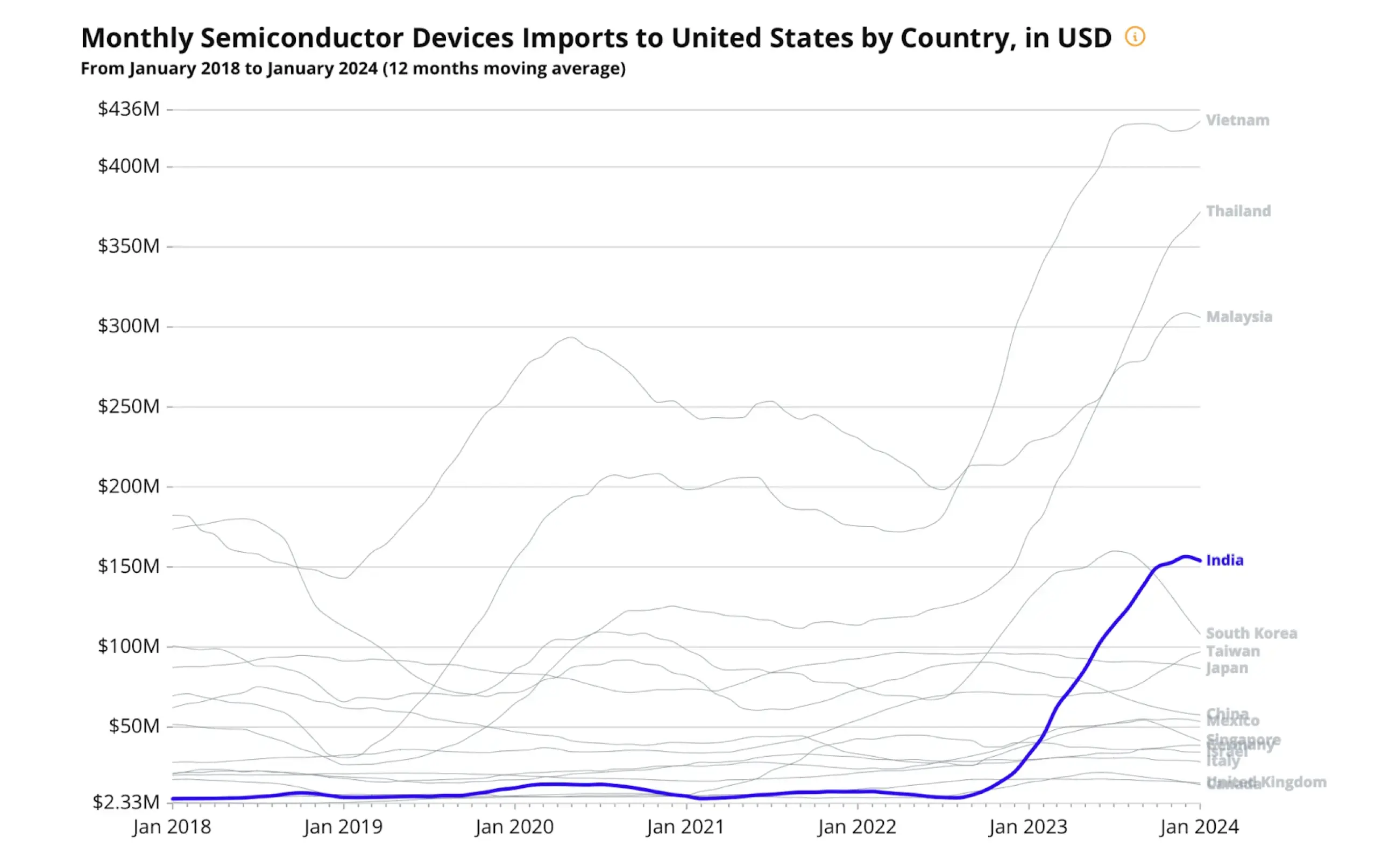

In the still emerging semiconductor industry, India has seen rapid growth helped by more than $10 billion in government incentives with the goal of creating a fully domestic production ecosystem. Among the early payoffs has been a doubling of semiconductor exports to the U.S. inside of a year. Look for this sector to become a potential mainstay of India’s tech exports.

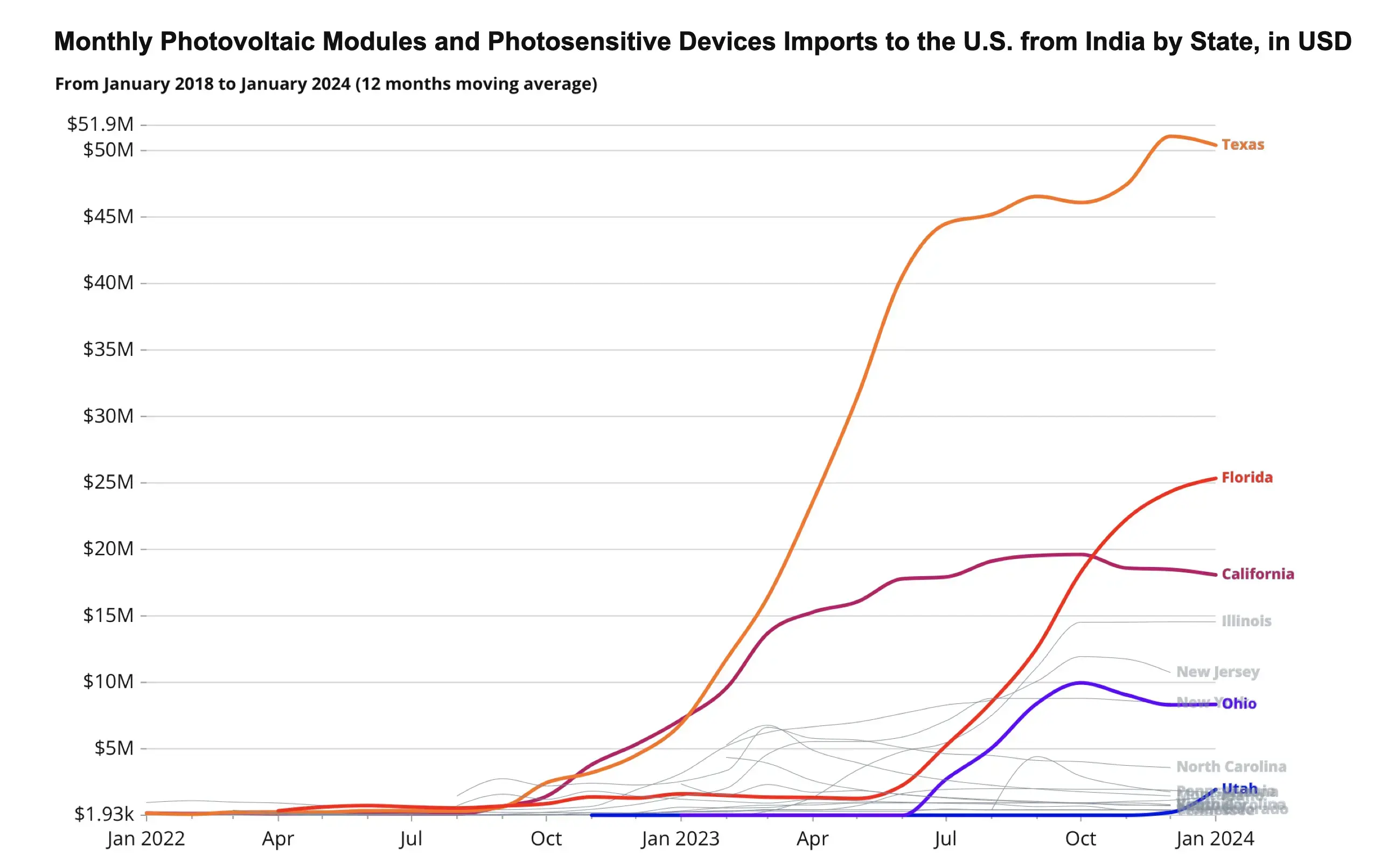

India's expanding semiconductor prowess is evident in the photovoltaic sector. For example, ACCIONA Energia’s Red-Tailed Hawk project in Wharton County, Texas, which has a capacity of 350 MWac—enough to power 66,500 households—sources bifacial solar PV modules from Waaree. These modules are shipped from Jawaharlal Nehru Port in India to Houston, Texas. Based in Mumbai, Waaree is a leading exporter and shipped over 6GW of these modules globally in 2023.

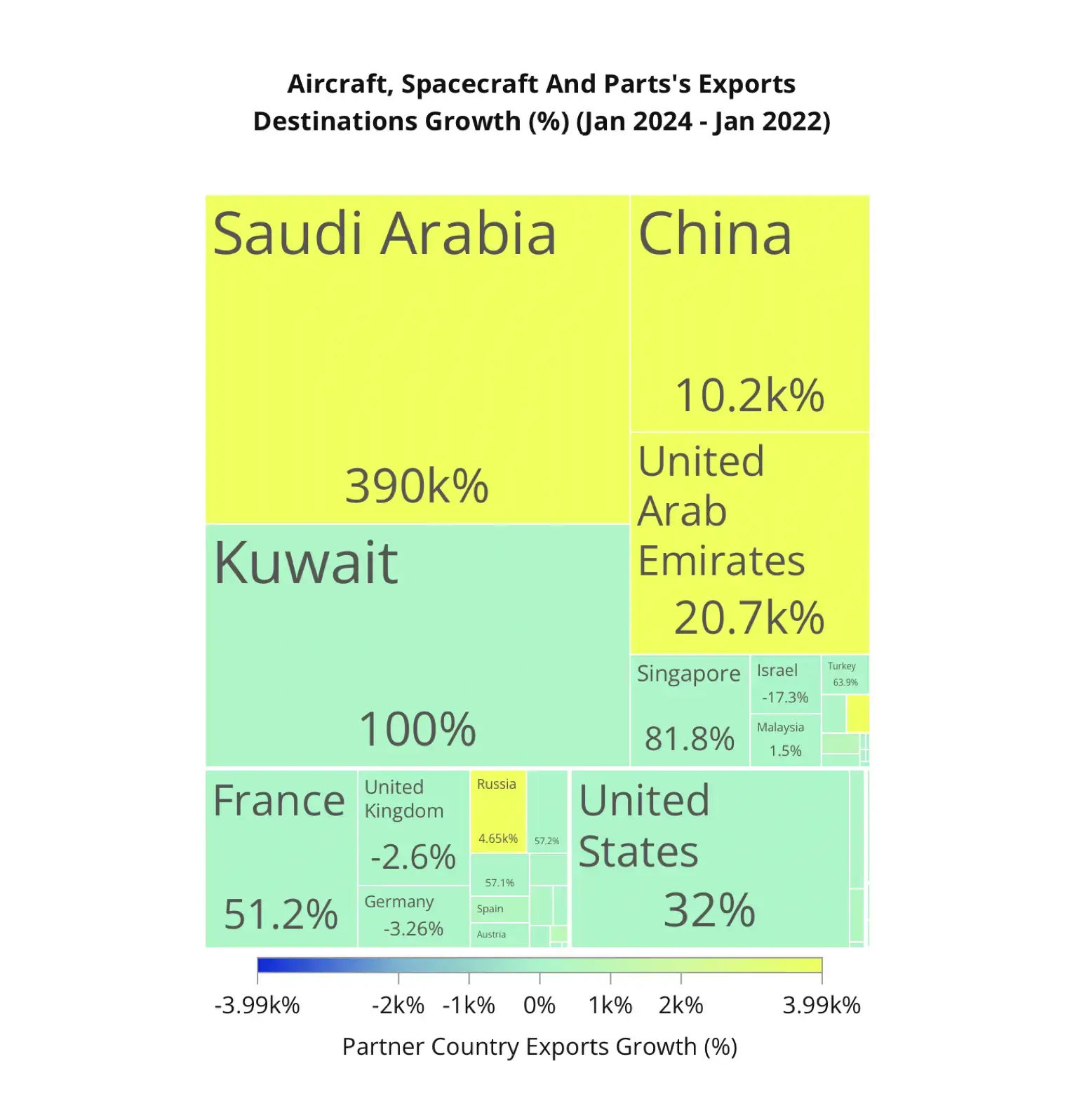

The drone industry's expansion has delivered thousands of additional sales to Saudi Arabia, the UAE and even China in just over two years. These cost effective drones meet growing demand in agriculture, mining, and basic surveillance applications.

This graphic shows dramatic growth but the question for India is can these numbers eventually be sustained without huge government subsidies and incentives?

Risks and Pitfalls in a Competitive Tech Space

India’s trade narrative as it emerges as a player in the high-tech economy will be a story of finding a foothold amidst global scale demand and growing manufacturing capacity for smart digital devices. The potential for substantial growth must be weighed against the perils of a costly glut in telecommunications and semiconductors. However, it faces challenges like market overcapacity and the volatility of strategic metal prices.

India's renewable energy sector is another growth center. Solar and wind energy production has positioned the country as a frontrunner in renewable power. An impressive annual growth rate of 23%, helps achieve international environmental objectives and also enhances India’s own economic stability by reducing reliance on imported fuels, which comprised nearly 25% of the country’s total energy consumption in 2020.

Shielding the economy from market shocks through diversification and policies that build and take advantage of a highly skilled workforce, are strategic winners in achieving sustainable growth in this turbulent era. Clearly, India’s high-tech exports still face challenges from market volatility, intense global competition, and the need for continuous innovation and skill enhancement. Geopolitical tensions threaten supply chains, and are likely to constrain tech growth as well.

Finding the Right Strategy to Thread the Delicate Needle

India's transition to a diversified, high-tech economy requires multifaceted interventions to foster innovation, enhance infrastructure, and adapt to global economic shifts. With the right policies and strategic planning, India can achieve sustainable growth and become a leader in the global technological landscape.

Investments in research and development, increasing public funding for semiconductor design and AI, expanding STEM education and vocational training in tech fields are all parts of the strategic mix.

Regulatory reforms to reduce bureaucratic hurdles, simplify startup formation, and tax incentives for innovators with protections for intellectual property rights are critical front-end interventions. On the back-end, establishing robust internal supply chains can shield India from global disruptions while maintaining manufacturing and logistics capabilities to grow market share in challenging times.

Integrating environmental sustainability into national policy through cleaner technologies would not have been seen as possible for the India of a generation ago. Today, however, we see Indian leadership driving sustainable growth and securing a place of significant influence in the global market of the future.