Chips on the Table: The High Stakes Industry of Semiconductor Design and Manufacturing

Our most critical technological challenges and geopolitical competitions unfold at the silicon table. The rising global demand for semiconductors has turned Nvidia, TSMC, ASML into dominant designers and manufacturers. These companies and national policies intersect in a world where making war, peace, and global economic stability depend on a nation’s stack of chips.

Everywhere All The Time

Semiconductors power devices from smartphones to missile shields. 5G networks currently support up to 1 million devices per square kilometer. By 2025, smart cities and industrial automation will drive demand for 75 billion IoT devices, all reliant on the semiconductor infrastructure.

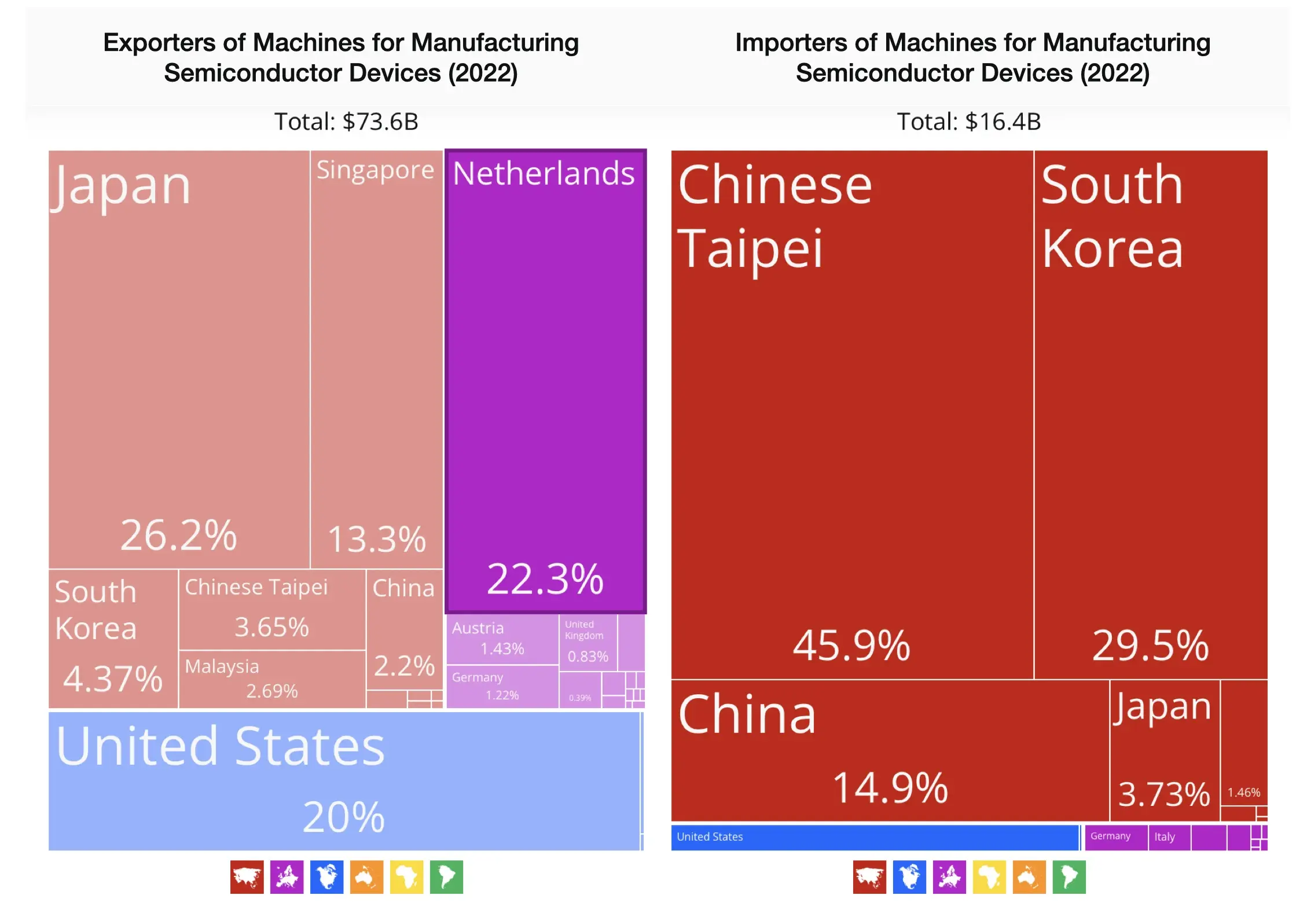

In 2022, semiconductors accounted for more than $156 billion in trade, with projections to reach $1 trillion by 2030. The U.S. semiconductor sector, comprising less than 5% of global exports, employs 250,000 people directly and indirectly supports four times that number.

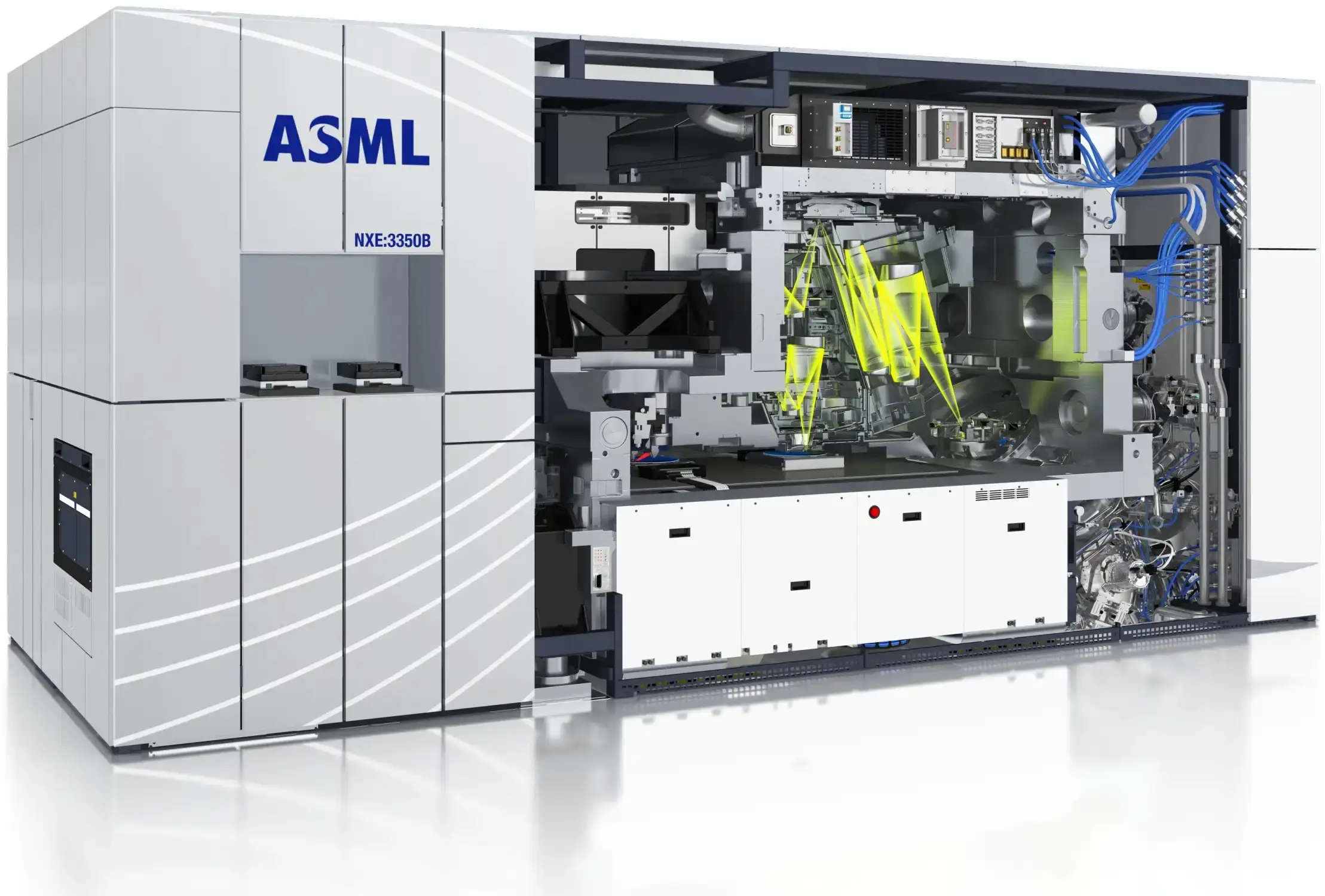

Semiconductors can scale up in massive interconnected networks and simultaneously scale down to the nano and molecular level. Extreme ultraviolet lithography (EUV), prints most advanced semiconductors while nano-scale etching using the shortest manageable wavelengths of light are used to etch the most intricate circuits. Only a handful of companies have access to this technology.

Interdependence of Nvidia, TSMC, and ASML

Nvidia, based in Santa Clara; Taiwan’s TSMC; and the Netherlands’ ASML together form a critical semiconductor ecosystem. Nvidia’s advanced GPUs rely on TSMC’s sophisticated fabrication processes. TSMC, in turn, depends on ASML, the exclusive supplier of advanced EUV lithography machines for top-tier chip production. This troika of interdependent companies is uniquely influential in the 21st century global economy.

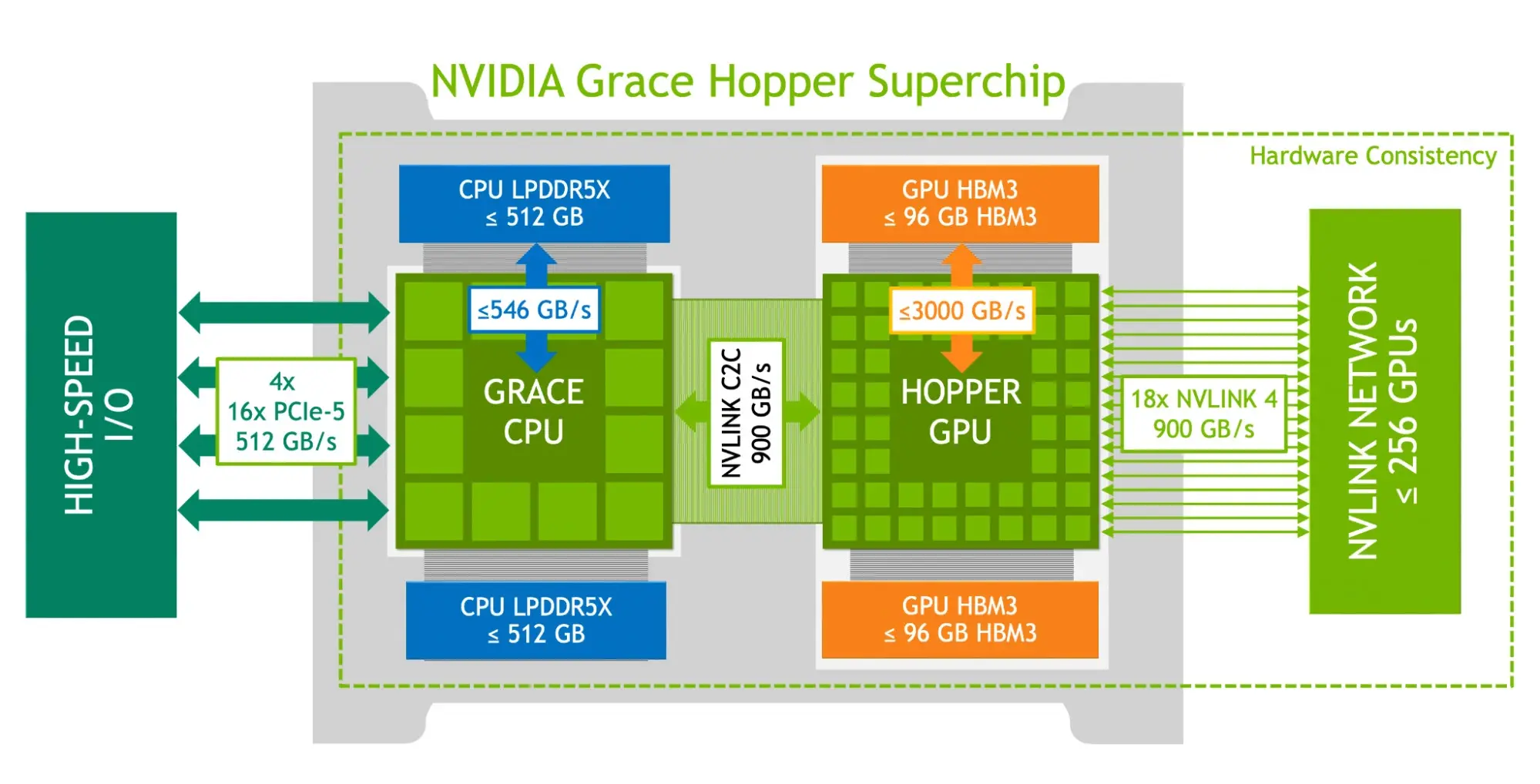

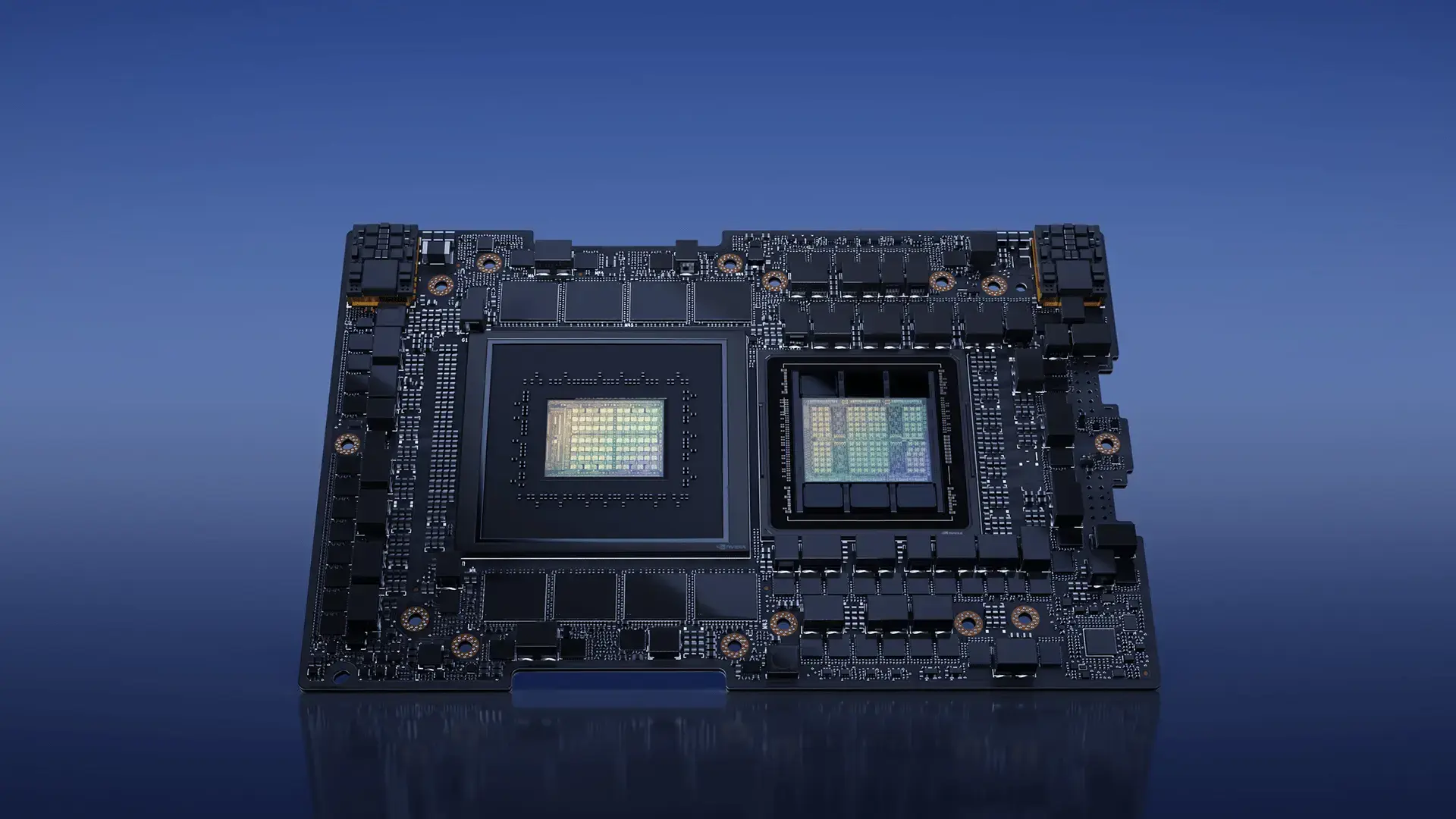

In 2023, Nvidia introduced the Hopper GPU architecture, enabling AI, deep learning, and high-performance computing applications. Hopper has amplified the influence of the big three. Nvidia delivered Hopper, which in tandem with TSMC’s 4-nanometer technology creates designs that raise the bar of optimized performance which are then brought to life with ASML’s EUV lithography. The end result is ultra-fine, dense, intricate circuits with unmatched capability.

Value Chains of ASML, Nvidia, and TSMC: A Closer Look

ASML’s photolithography machines, costing over $150 million each, require over 100,000 specialized components from around the world. HQ Pack ensures these machines arrive in pristine condition. Key suppliers include Japan’s Turbo-HKS for filtering machinery, Senqcia Corporation for aluminum structures and precision tools from DMG Mori. Advanced optical components come from Germany, with medical sterilizers repurposed for cleanrooms.

Nvidia’s top-tier suppliers include Nvidia Singapore for video game assembly and the Shield P2897 Android TV game console. ASRock Rack, based in Taiwan, supplies server and AI training systems, including components for the Grace Hopper Superchip and HGX H100 GPUs, with shipments originating from Chi Lung and Kao Hsiung. Huizhou BYD Electronic Co. assembles gaming systems in Hong Kong. Mellanox Technologies provides networking components from Xingang. Hong Kong Welltest offers automated testing equipment from Yantian, while Hiram Xiao and ZKL New Materials supply cushioning and packaging materials, respectively.

TSMC’s multibillion-dollar “Taiwan in the Desert” facility in Arizona is delayed, with production set for 2025. Despite setbacks, both TSMC and The U.S. Department of Commerce remain committed to building semiconductor manufacturing outside of Asia. Shipment volumes spiked during March and April 2023, while high volumes of equipment and construction are expected in May of this year through October.

Diverse suppliers support the Arizona expansion including Tokyo Electron Limited which provides semiconductor manufacturing equipment, United Integrated Services supplies infrastructure, and Murata Machinery delivers automated material handling systems. Contributions from Applied Materials and Lam Research include advanced tools and wafer fabrication equipment, Additionally, TSMC relies on ASML for advanced lithography machines and Japanese chemical companies for light sensitive polymers called photoresists and other specialized chemicals for semiconductor manufacturing.

National Security Implications

In 2023, the U.S., Taiwan, and South Korea control 68% of the world’s advanced semiconductor foundry capacity. Taiwan, led by TSMC, produces 70% of sub-7 nm chips, increasing its attractiveness to China and raising Pacific tensions. The U.S. is trying to catch up with the $50 billion CHIPS and Science Act.

The semiconductor sector is already a trade battlefield. The U.S. and Europe have imposed export controls restricting China’s access to sub-5 nm chips crucial for AI and military applications. These embargoes may accelerate China’s domestic semiconductor capacity.

Meanwhile, in the United States Intel is mounting a comeback with a federally supported $20 billion investment in two new Arizona chip plants. Micron Technology is committing $50 billion through the decade to build advanced memory chip facilities in New York and Idaho, supported by $6 billion in federal grants.

Wavelengths of Innovation: The Future of Photolithography

The next generation of photolithography machines is expected to emerge from a combination of established players and innovative newcomers. ASML, a leader with its recent TWINSCAN NXE:3400C, is advancing EUV lithography into the sub-2 nanometer realm. Taiwan, home to TSMC, which holds over the 90% of the global market share in most advanced processors, is well-positioned for further EUV development. In the U.S., the CHIPS and Science Act aims to foster new semiconductor hubs in Silicon Valley, Arizona and New York, backed by a $52 billion funding package. With its strong industrial base and companies like Zeiss, a key ASML collaborator, Germany stands out as a significant contender. Japan and South Korea, known for their precision engineering and companies like Nikon and Samsung, along with emerging players from China driven by substantial state investment, are also expected to contribute significantly. This global effort is crucial to meet the growing demand for advanced semiconductors and to ensure technological and national security.

Conclusion

The global semiconductor industry is a strategic asset intertwined with national security and economic influence. The cooperative strength of companies like Nvidia, TSMC, and ASML, along with new manufacturing capacity being built in the U.S. and elsewhere, is crucial for securing independent supply chains amidst rising geopolitical tensions. A robust semiconductor manufacturing capability not only fuels economic growth and enhances consumer goods but is part of a balanced tech race essential for global stability. The strategic management and growth of semiconductor resources will drive geopolitical dynamics for the rest of the 21st century.