Bystander Bonanza: How Mexico Pulled off a Victory in the U.S.-China Trade War

In the U.S.-China trade war battlefield, Mexico cleans up. The U.S.'s leading goods supplier is no longer in the Far East. The new “Near South” is open for business.

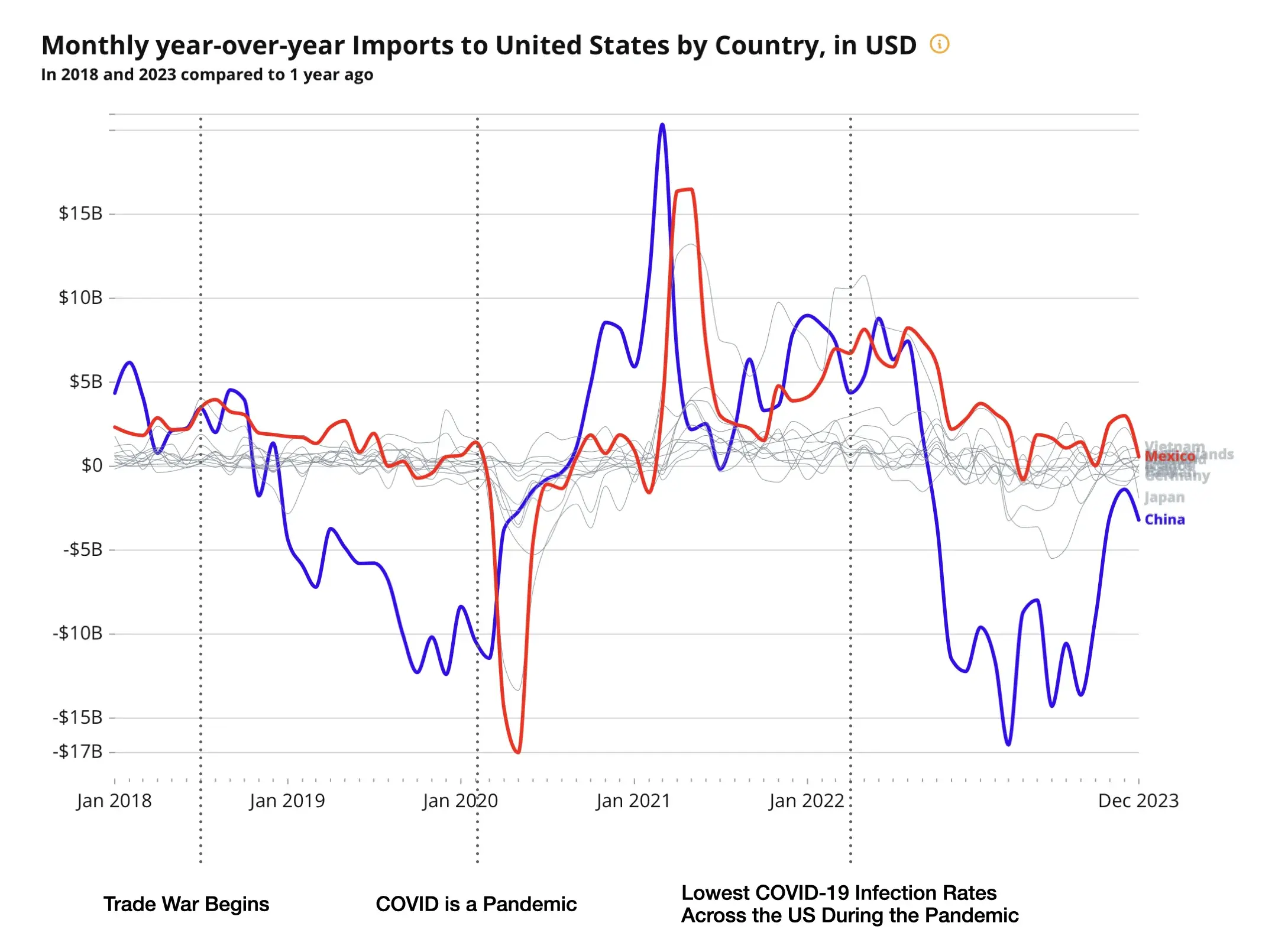

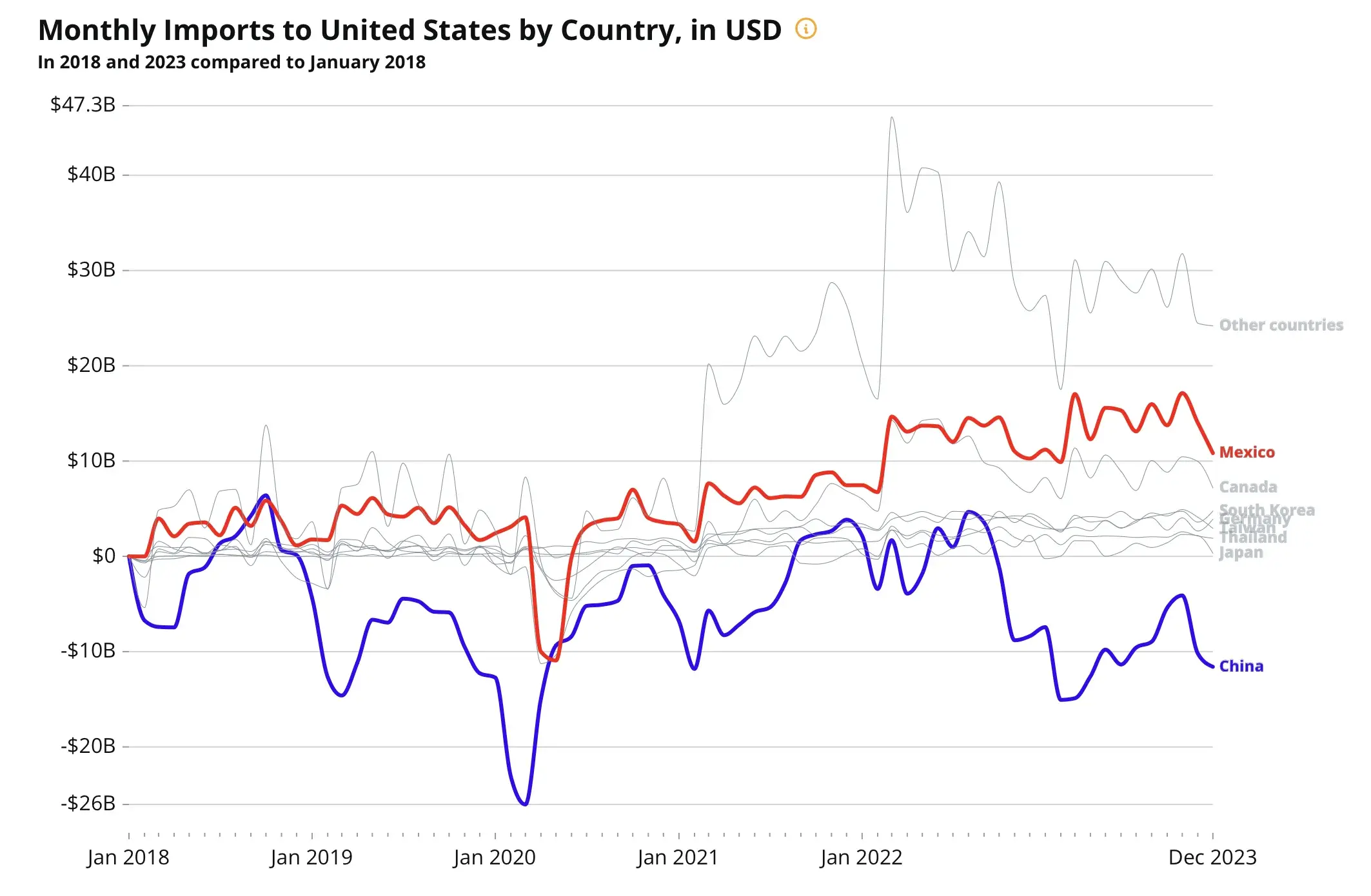

Global Trade’s “Great War” between the US and China is an economic conflict on a scale that hasn’t been seen in the modern era. The 21% reduction in Chinese exports to the U.S. since July 2018 has diverted a mighty river of economic activity and created a “bystander economy.” Perhaps the biggest and savviest bystander is Mexico which has overtaken China as the U.S.'s main goods supplier. This is a major reversal in North American trade patterns, and the 21st century is just getting started.

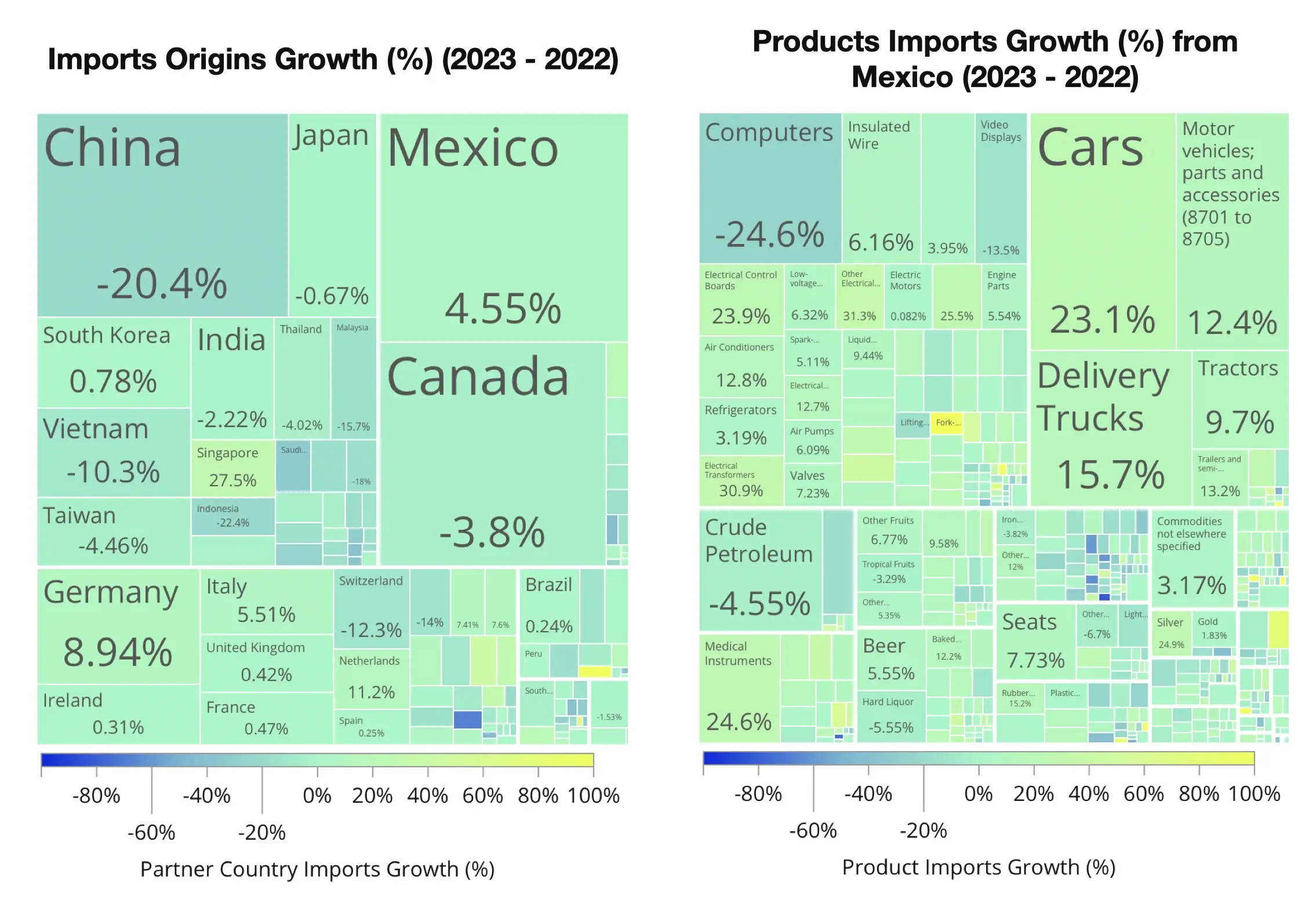

In 2023, Mexico's exports to the U.S. increased by 4.5%, while China’s slipped 20.4% and Canada’s deliveries fell 3.8%. This expansion was driven by more than just geographical proximity. Mexico's effort to radically diversify and broaden its economic foundations away from oil and natural resources reaped a rich harvest. This one nation’s story tells how the pursuit of economic complexity through data driven strategies, anticipating world events can be transformative. Mexico’s "China Plus One" strategy aimed at reducing the risks of being drawn into the U.S.-China trade tensions while simultaneously benefiting from them, is part of this broad vision.

Mexico's rise during the trade war and its impact on worldwide trade patterns looks to be a model for policy in this century. Trade figures, and growth in vital sectors confirm the robustness of this model. To understand Mexico's strategic edge in U.S. trade relations we'll also review how Taiwan, Vietnam, Thailand, South Korea, and Germany have achieved similar results in response to the U.S.-China trade dispute. The data confirm how Mexico's recovery as the primary provider of manufactured goods to the U.S. is a viable and even inspired approach for developing economies to turn political tensions into economic resilience and expansion.

Complexity by Sector: Diversification Runs Deep

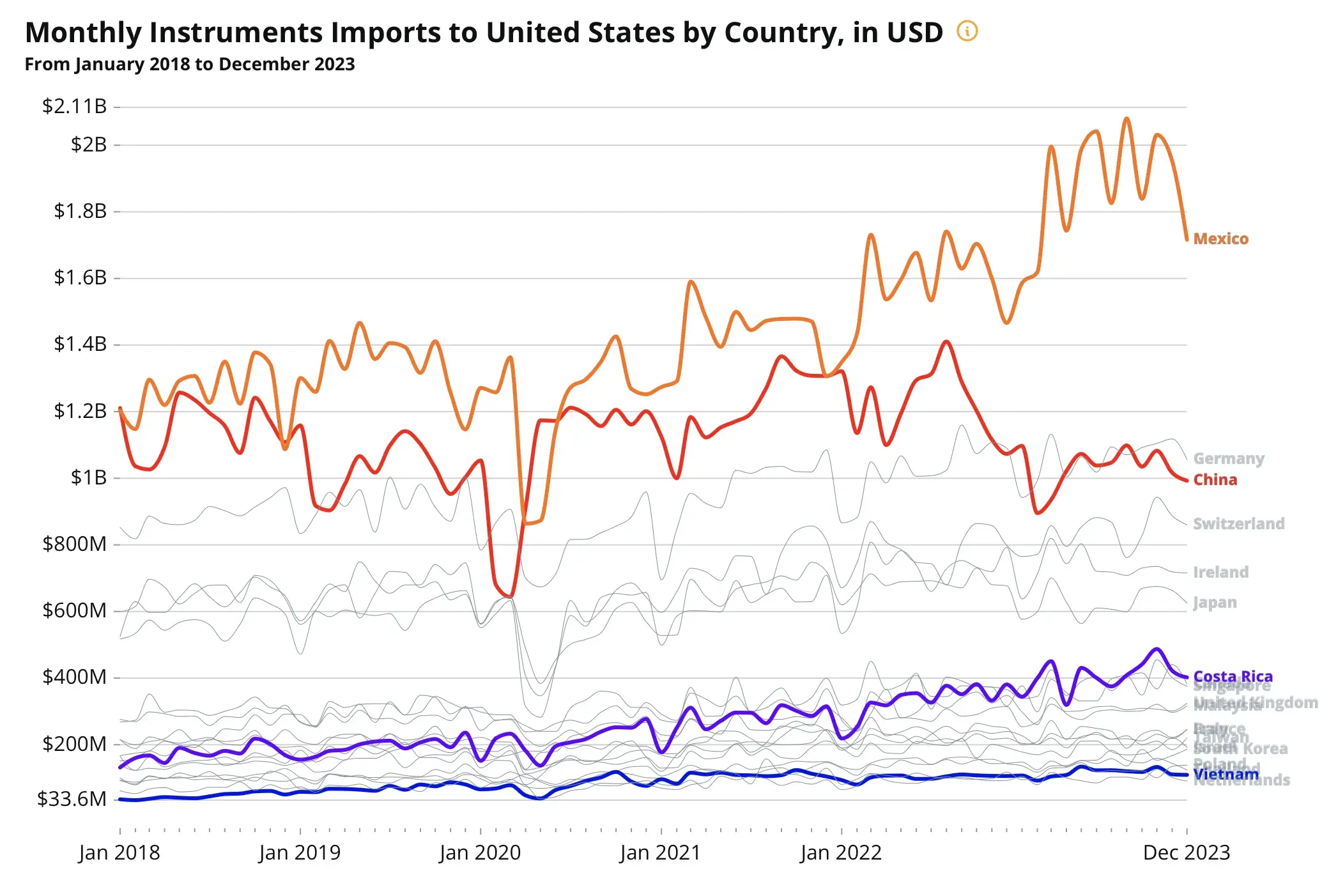

Mexico's strategic stronghold in the U.S. market is a sector by sector replication of the tactic of anticipating change, accurately assessing investment costs of specialization, rapid adaptation to shifting U.S. market demands and delivering swift and significant growth. The medical instruments, electrical machinery, and electric cars sectors highlight the impressive dynamics behind Mexico's trade expansion.

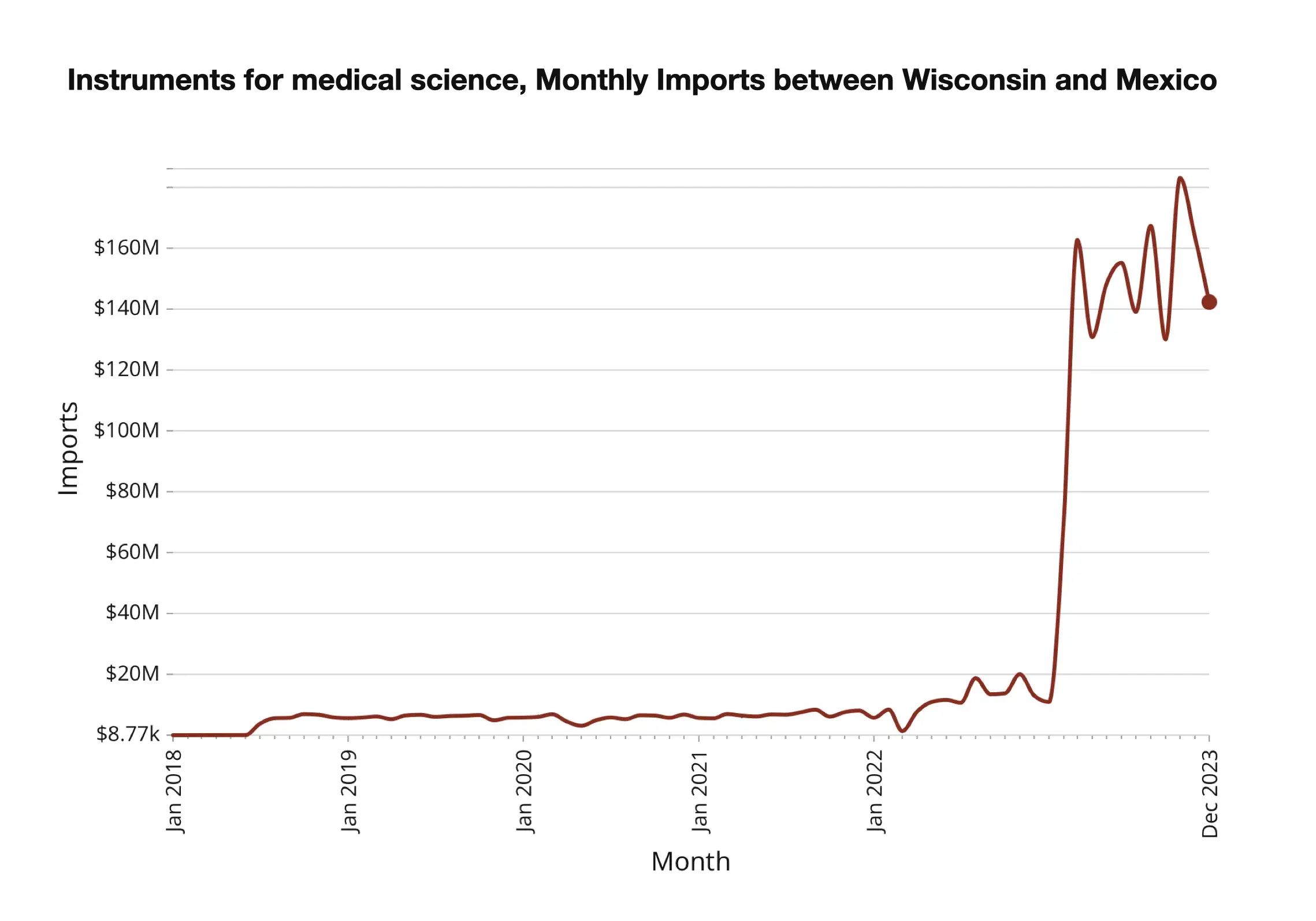

Mexico's contribution to U.S. medical instrument imports rose to 31.4% in 2023, up from 25.6% in 2018. In the state of Wisconsin, known more for its cheese than being a hub for medical research, Mexican businesses found a valuable synergy. The Medical College of Wisconsin, with its $318 million research investment and 452 patents in fiscal year 2021 is an IP leader in medical imaging research. But duplicating that leadership in manufacturing was a challenge until Mexico entered the picture and by 2023, became the source of 75% of Wisconsin's scientific medical instruments, a dramatic increase from 23.7% in 2018. Over the past three quarters, Wisconsin's imports of these instruments from Mexico grew by 1,090%. Mexico's success in quickly meeting U.S. demand for medical and scientific instruments can be seen in the dizzying vertical spike in the charts below.

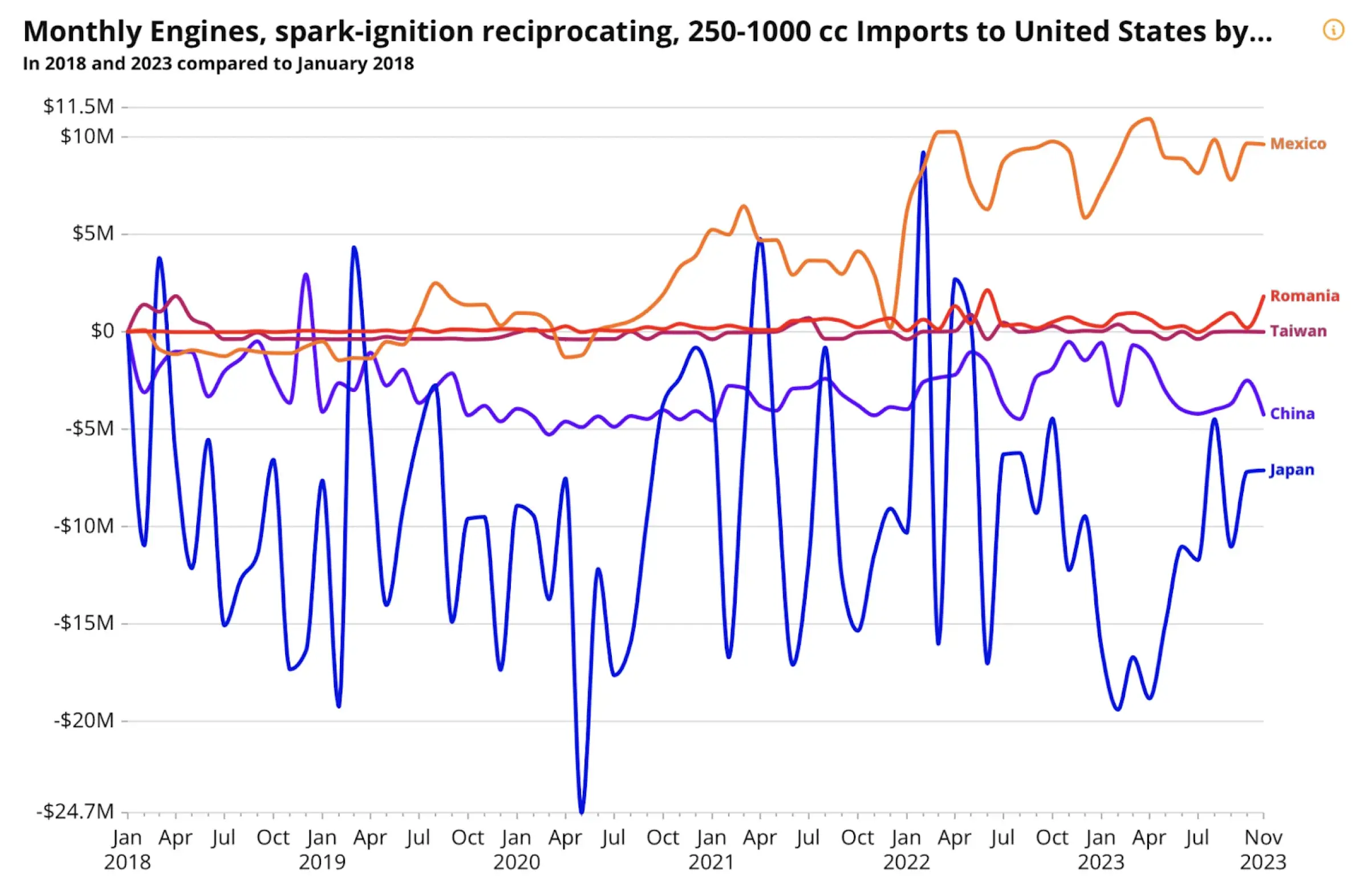

The electrical machinery and electronics sector, particularly spark-ignition reciprocating engines, is another example of Mexico's strategic specialization. In 2018, Mexico's exports of these engines were $17 million, only 0.52% of the global market. By 2023, following the U.S.-China trade war and supply chain shifts, Mexico's U.S. market share soared to 26%, far exceeding China's 6.36%.

This leap highlights Mexico's prowess in manufacturing complex components and the shift towards reliable, geographically proximate suppliers. BRP Inc.'s expansion in Querétaro now exports engines ranging from 250 to 1000 cc to Houston, Texas, based on 2023 company-level data from the OEC. Queretaro's advanced manufacturing parks, skilled engineers, and infrastructure, all support sophisticated production like BRP's Rotax engines and their new electric Can-Am motorcycles and batteries. Global demand growth for high-performance engines positions Querétaro as an innovation hub, and a complexity engine, in its own right, helping drive a national realignment towards high-value manufacturing.

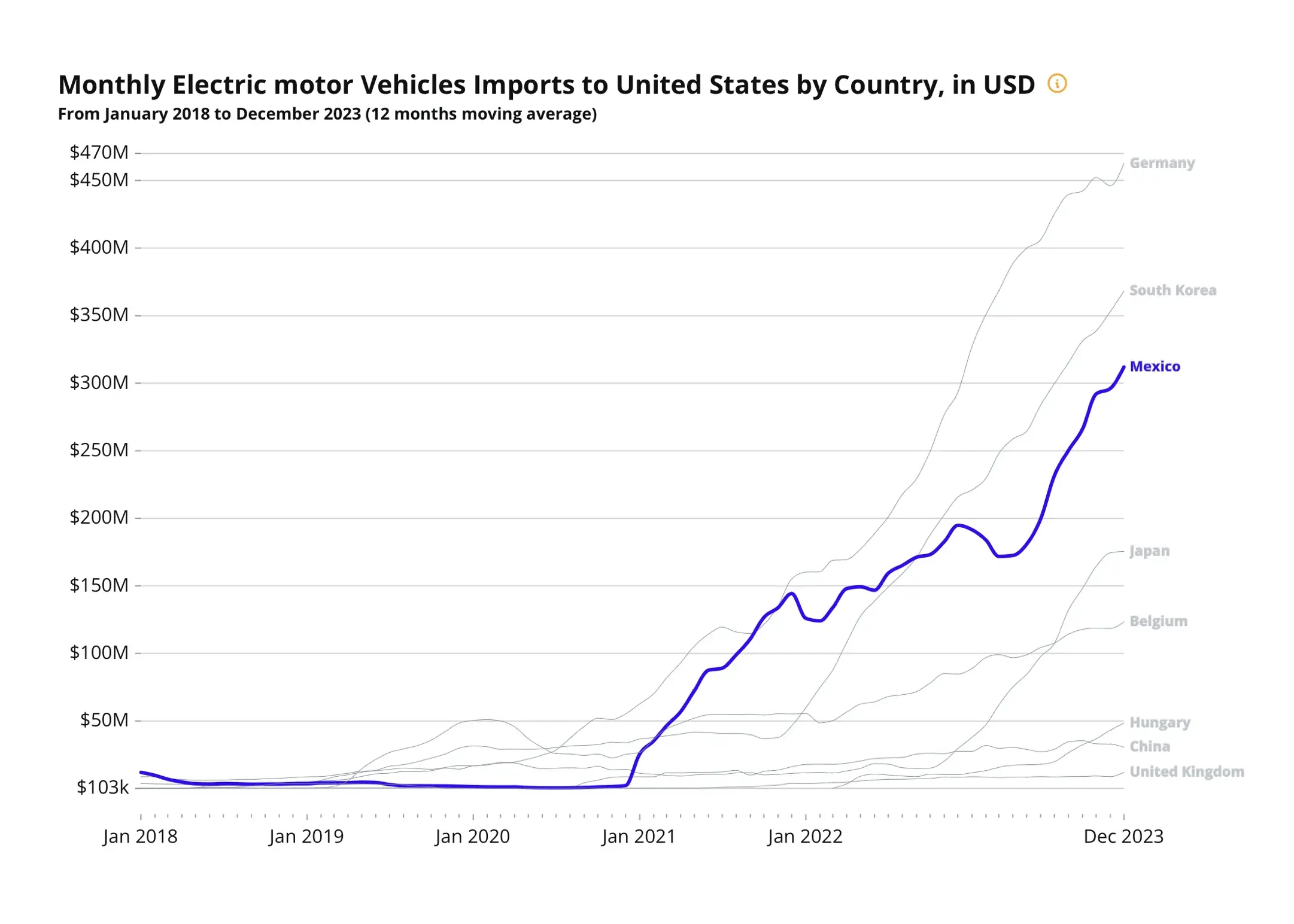

The automotive industry's shift towards electric vehicles (EVs) has landed solidly in Mexico. Tesla's mega-factory in Monterrey and General Motors' expansion in Ramos Arizpe are significant capital investments in Mexican EV manufacturing that undoubtedly raise Mexican influence on U.S. industrial policy.

The Inflation Reduction Act (IRA) prepared the U.S. market for EVs, by boosting EV adoption and domestic manufacturing. Key provisions mandate that EVs must be assembled in North America, with specific requirements for critical minerals and battery components to access full tax credits. Mexico's growth in the North American automotive industry is a critical piece in the transition to sustainable transportation.

In 2023, Mexico's EV exports to the U.S. rose by 60.2%, making it the third-largest EV supplier to the U.S.

Medical instruments, engines and electric vehicles are just three examples of how, by leveraging existing strengths and aggressively pursuing new opportunities, Mexico is positioning itself as a leader, perhaps for decades. The seamless transition between traditional and emerging industries comes from a cooperative proactive approach to national industrial policy. By focusing on high-value manufacturing and innovation, Mexico leaps over transient current trends to land solidly in the permanent landscape of world trade in this century.

The Lucrative Bystanders: Beyond Mexico

The U.S.-China trade war has fueled the economies of Taiwan, Vietnam, South Korea, and Germany to capitalize on new opportunities. As businesses diversified supply chains to dodge trade tensions, these bystanders emerged as part of a long term trend of continued growth.

Vietnam stood out with a whopping 508% growth in exports to the U.S. since the onset of the trade war, mainly in computers and semiconductors. Vietnam has arrived as a tech manufacturing hub, offering a cost-effective, reliable alternative to Chinese production lines.

Taiwan’s 397% increase was largely due to Taipei Integrated circuit leadership. Taiwan has attracted businesses eager to reduce dependence on Chinese chips bolstering its key role in the tech supply chain.

Thailand's exports to the U.S. grew 344%, driven by production of solar panels, GPUs, and cellphones. Thailand looks to be an emerging hub in renewable energy and advanced electronics significantly broadening its traditional manufacturing capacity beyond apparel, tires, and processed food.

South Korea saw a 309% jump, particularly in car and electric battery exports. Its advanced manufacturing and leadership in the auto and electronics sectors made it an attractive choice for diversifying sources.

Germany's exports grew by 266%, excelling in cars and electric machinery. With its reputation for engineering excellence, Germany used the trade war to strengthen its automotive and machinery sectors focusing on innovation and electrification trends.

Conclusion

The U.S.-China trade war has significantly reshaped global trade dynamics, propelling Mexico to become the leading supplier of goods to the U.S. in 2023. This transition was fueled by geographical proximity, Mexico’s strategic specialization, and the global shift toward supply chain diversification. Mexico demonstrated remarkable growth in sectors like medical instruments, electrical machinery, and electric vehicles, showcasing its ability to adapt to market demands and capitalize on shifting trade and policy priorities.

Mexico's ascent and the success of the other “bystander economy” nations noted here, all demonstrate the importance of adaptability, integration, and competitiveness. The U.S.-China trade war, while disruptive, has opened new pathways for growth and diversification across the world.