Suez Canal: Engineering Marvel And Crisis Chokepoint

Canal Blockages in the Suez and in Panama have amplified the urgency for closer cooperation on global trade. Economies and industries dependent on a few critical maritime routes make essential goods, from food grains to electronics vulnerable to violent disruption.

Suez Canal: Rich With History, Richer in Strategic Significance

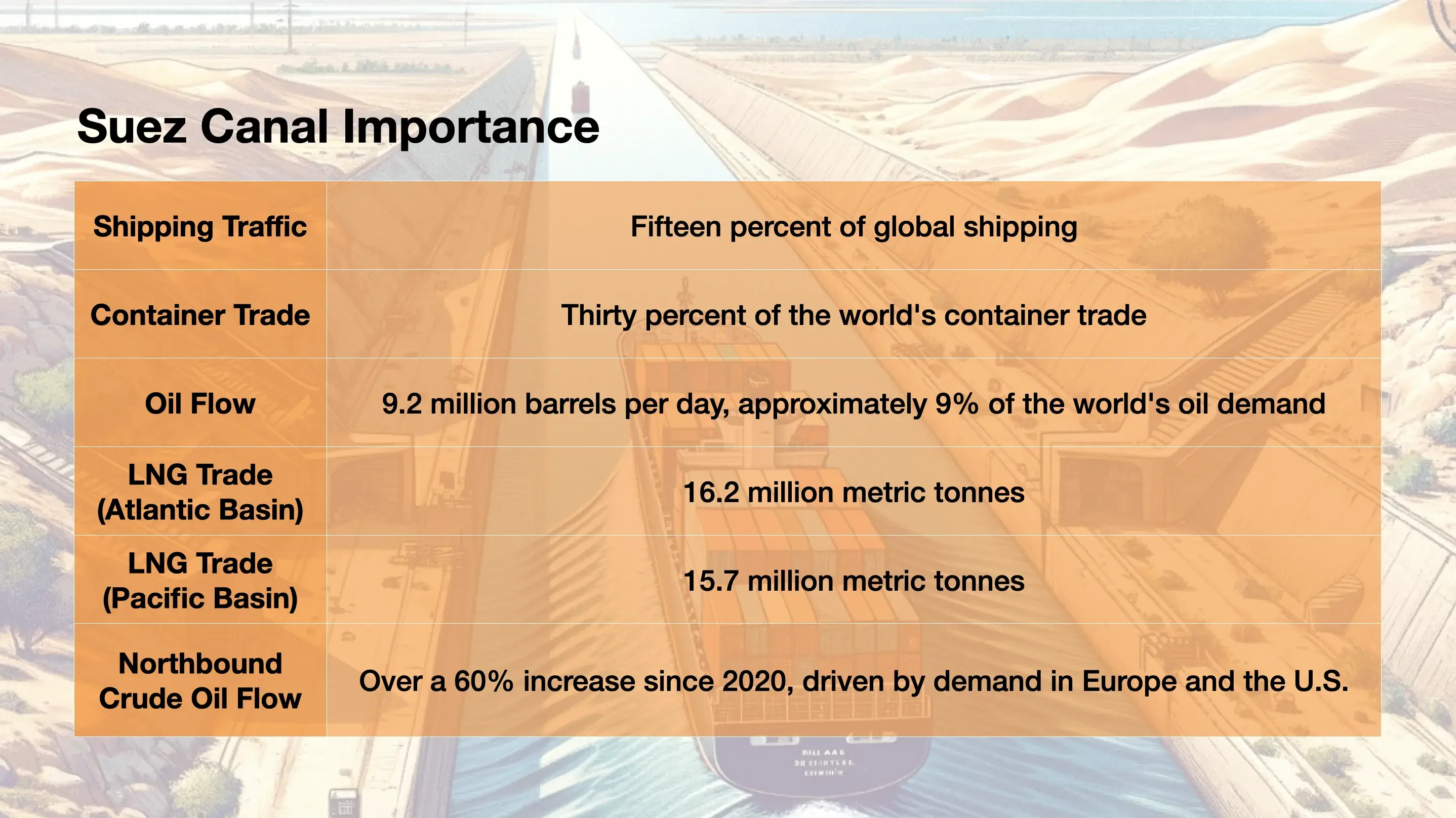

It processes 10-12% of global trade, over USD 1 trillion per year, and 30% of global container traffic. Annually, about 9% of global oil trade passes through the Suez.

The Canal has always been a potential target during times of instability but its importance to all sides has been its most reliable defense against attack. The Yemeni based Houthi militia has changed the strategic picture with substantial economic consequences. The militia backed by Iran, has forced the rerouting of ships in the Red Sea approach to the Suez. Container shipment costs, in delays, fuel, and insurance premiums have soared. Brent crude oil prices have escalated by approximately 8% since the onset of the crisis. The canal is central to many global supply chains, with trillions in trade value hinging on its security. Its role is fundamental in maintaining global economic stability.

A Canal’s Carbon Consequences

A crisis that forces detours for ships has an immediate impact on CO2. A container ship diverted around the Cape of Good Hope releases an extra 5,400 tonnes of CO2, equivalent to the yearly output of 1,174 cars. Even crisis-free, the maritime industry contributes about 2.5% of global greenhouse gas emissions.

The Houthi maritime threats and attacks have forced LG Electronics and Samsung to incur significant delays in semiconductor shipments. Working around delivery delays using air freight brings higher costs and sharply increased carbon emissions. A 5% drop in global smartphone shipments, might normally mean lower emissions but in this scenario, costs and carbon pollution both rise.

Ironically, Yemen, home of the Houthi militia, has been deeply affected by the canal attacks. Yemen is heavily reliant on food imports via the Suez Canal. Egypt, the world's second-largest wheat importer, expects more price increases in wheat. For Yemen, the stakes are higher: 90% of its crucial food imports faced disruptions, emphasizing the need for alternative transportation methods and increased storage capacities.

The current disruption in the Suez Canal highlights critical weaknesses in global trade. This event prompts a key question: how can we transform global trade, developing strategies that raise the level of cooperation and mutual defense of critical infrastructure to avoid similar disruptions?

Infrastructure, Global Trade’s Weak Link and the Urgent Need for Innovation

By 2040, an estimated $94 trillion investment is required globally to meet infrastructure needs. There’s a significant $18 trillion annual gap in infrastructure investment. Considering that approximately 80% of global trade is conducted by sea, the enhancement of maritime infrastructure, especially at chokepoints like the Suez Canal, Strait of Hormuz, and Strait of Malacca, is a top priority. Safeguarding and streamlining the arteries of global trade is a significant challenge for 21st century commerce.

Decentralizing global trade networks could limit the vulnerability of and dependance on canals and other critical infrastructure. Upgrading efficiency by as much as 30% is widely believed to be in our grasp. Decentralized networks could reduce supply chain disruptions by as much as 40%, a critical consideration in the era of “just in time” manufacturing where supply chain resilience is paramount. Building greater economic complexity using the tools of global trade can provide economies with the means of adapting to rapid changes and unforeseen challenges.

Learning from the Past, Preparing for the Future

The 1956 Suez Crisis, caused a historic surge in oil prices and significant economic disruption. If anything, our 'just-in-time' supply chains, in the electronics and automotive sectors are even more vulnerable to disruption than the markets of nearly 70 years ago. This lesson was brought home during the COVID-19 pandemic. In the current Suez crisis elements of history are showing signs of repeating themselves.

The more than week long 2021 blockage of the Suez by the supermega containership the Ever Given carrying $700 million in goods ended up stopping $60 billion worth of trade. The $1 Billion worth of claims and insurance costs are still being argued in courts around the world. The world learned it is just one big boat stuck in the mud away from a trade shutdown. Any regularity in such disruptions would cause significant macroeconomic impacts like price escalations and impede the growth of established and emerging industries, especially in Europe.

Navigating Beyond the Crisis: Resilience in Global Trade

The Suez Canal crisis illustrates once again, global trade's vulnerability, and need for built-in resilience and sustainability. Prioritizing infrastructure diversification, renewable energy in shipping, and decentralized trade networks are a realistic means to achieve a more robust and responsible global trade system. The global community's response to this challenge will set the course for sustainable free trade in this century.