U.S. Economy: Is Digital Trade Driving Another Soft Landing?

In the mid-1990s, the U.S. achieved a rare "soft landing." Today, hopes for a similar outcome face a vastly different, digital-dominated economy. This article explores the parallels and contrasts between then and now, and the crucial role of digital trade in shaping our economic future.

Some Basics

Economists say a "soft landing" is achieved when an economy decelerates just enough to curb inflation without causing a recession. Today, the U.S. economy appears poised to repeat such an outcome. The last notable instance of a soft landing occurred in the mid-1990s, driven by technological change and the emerging forces of globalization. The economic conditions of today are quite different from the 1990s nevertheless, exploring the potential for another soft landing can tell us something about the transformative role of digital trade in driving 21st century economic resilience.

Parallels Between Then and Now

In the early 1990s, the U.S. was recovering from a recession. By the mid-1990s, key indicators such as GDP growth, inflation, and unemployment had improved significantly, so today the 1990s is remembered chiefly for this successful soft landing followed by significant growth for the remainder of the decade. Digital tech even then was reshaping the U.S. economy by a surge in electronics trade fueled by globalization. Over time, as electronics became interconnected through the Internet, digital trade expanded into the networked and virtual economy we see today.

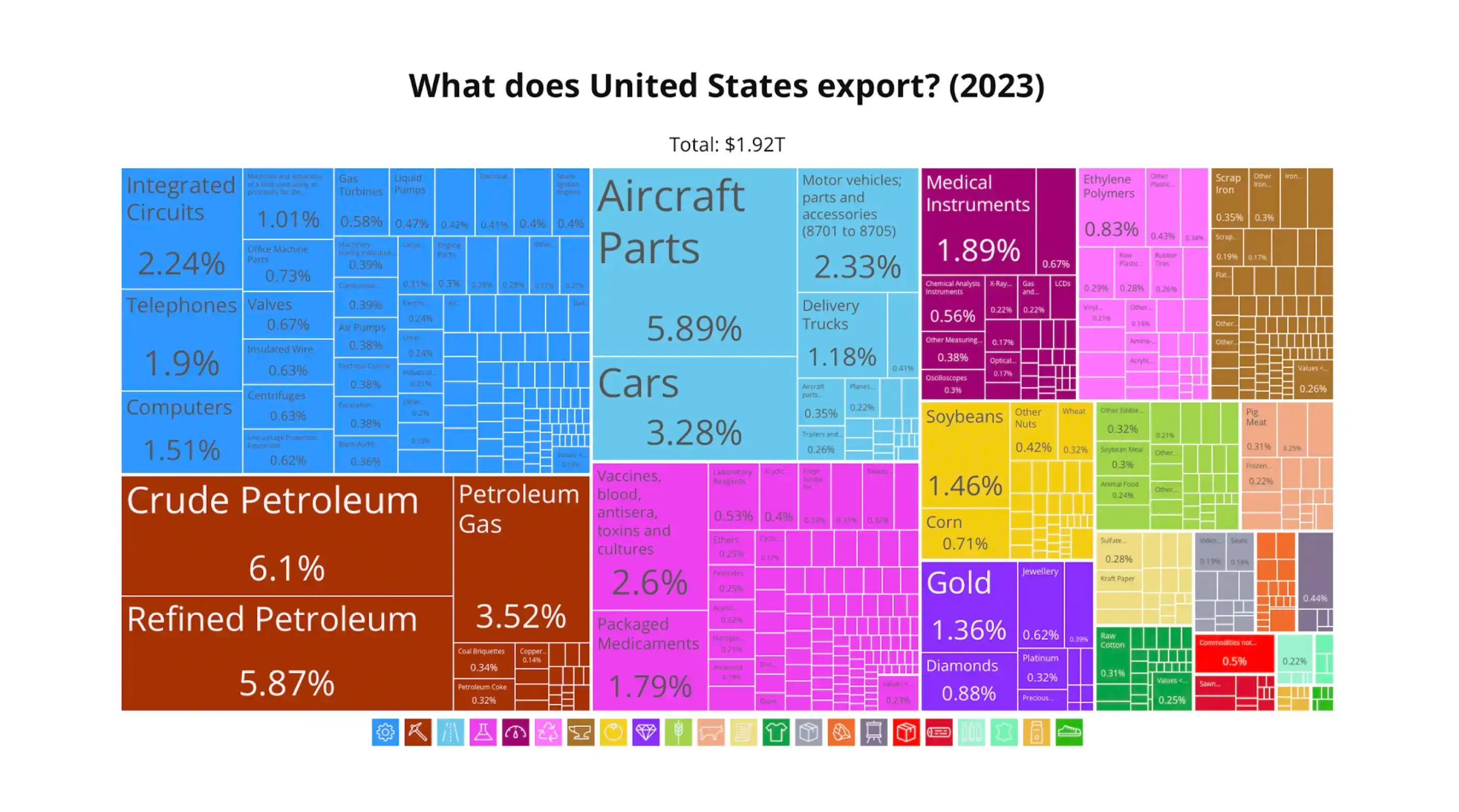

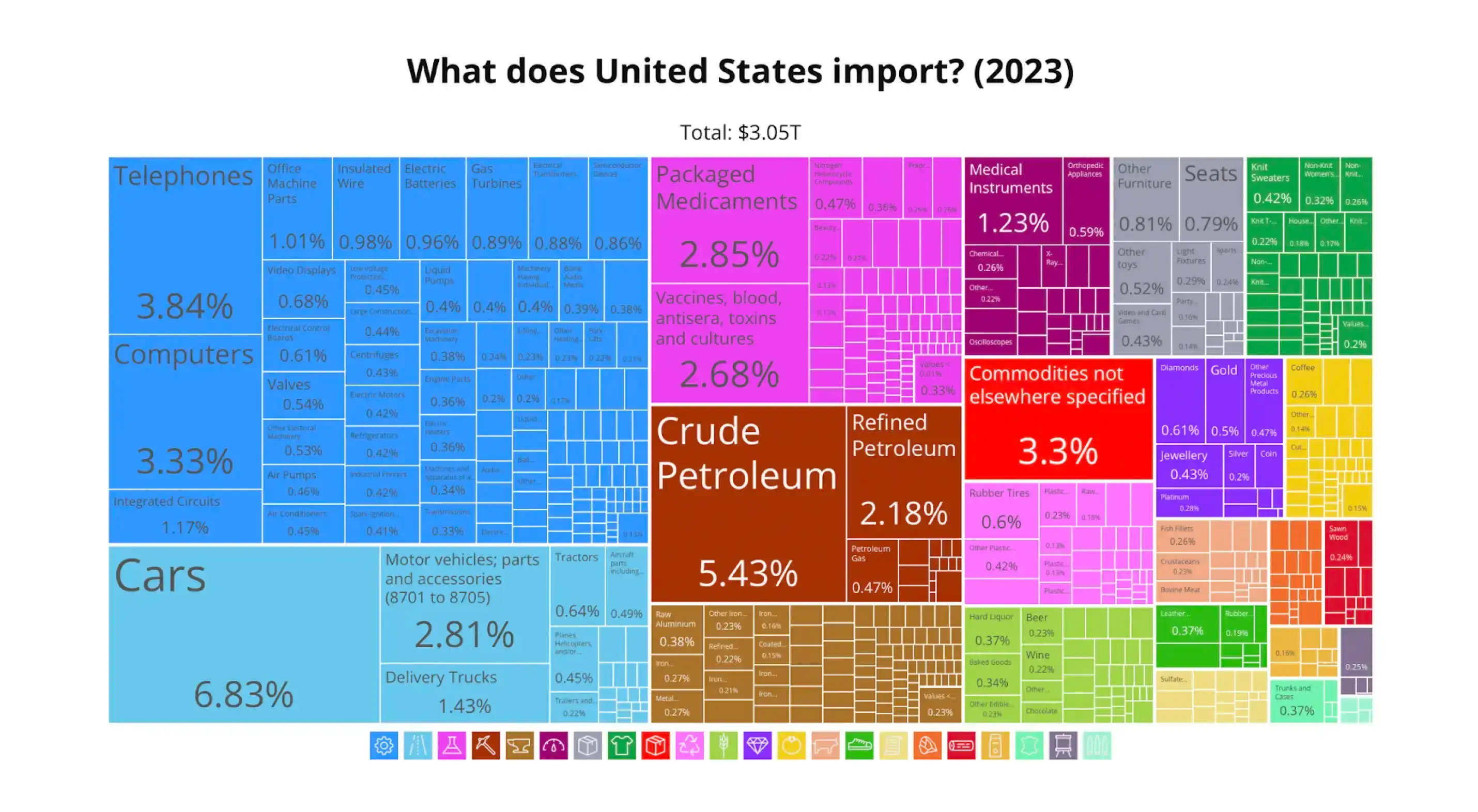

Trade dynamics in the mid-1990s were characterized by globalization and agreements like NAFTA, which reshaped trade relationships and boosted trade volumes. The U.S. trade deficit grew from $78 billion in 1993 to $96 billion in 1995, with major trading partners including Canada, Mexico, and Japan. Key exports were cars, computers, electronic microcircuits and aircraft, while imports were dominated by car s, electronic components, and crude oil.

In contrast, today’s trade dynamics are influenced by both physical and digital trade. The U.S. trade deficit in 2023 was $945 billion, with exports at $2.53 trillion and imports at $3.47 trillion. China has emerged as a major trading partner, contributing $382 billion to this deficit due to high imports of smartphones, laptops, and electric batteries. The U.S. export profile has shifted towards advanced technology, pharmaceuticals, along with oil and gas products, reflecting a move towards a more technology-driven economy while maintaining its legacy as a fossil fuel producer.

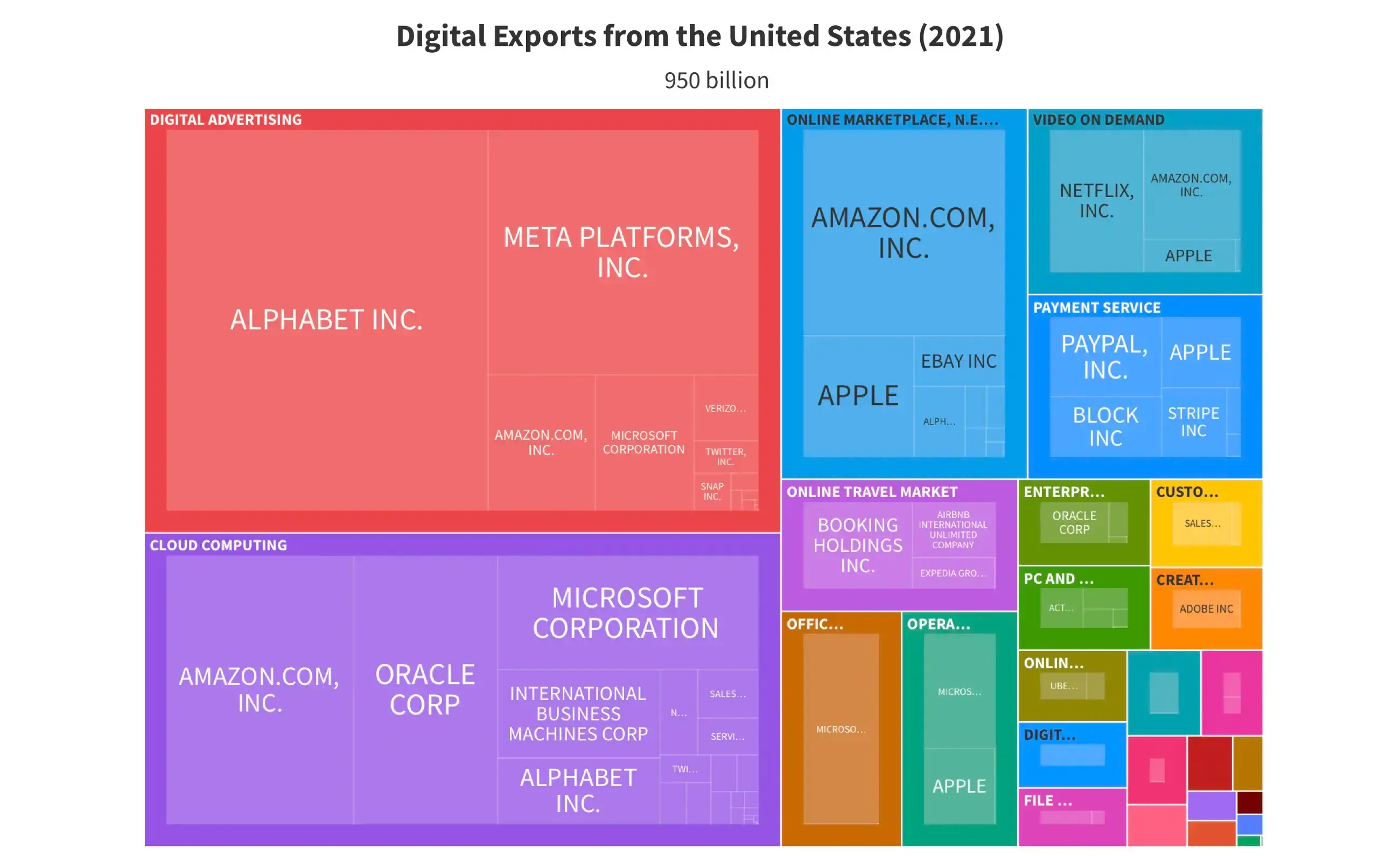

Digital trade has emerged as a critical component of this evolution. Global digital trade was estimated at USD 0.95 trillion in 2021 by Viktor Stojkoski & Philipp Koch & Eva Coll & Cesar A. Hidalgo in ‘Estimating Digital Product Trade through Corporate Revenue Data.’ The United States contributed nearly three-quarters of global digital product exports, based on the location of its headquarters. The most revolutionary export numbers from the United States include:

- Digital Advertising: $218 billion

- Cloud Computing: $161 billion

- Online marketplace: $73.7 billion

- Video On Demand: $35.4 billion

These figures highlight the rapid growth and significant impact of digital trade on the aggregate complexity of the U.S. economy. Digital trade not only enhances economic resilience by diversifying export portfolios but also drives innovation and productivity. Major tech firms headquartered in the U.S. lead global digital markets, creating high-value jobs and attracting significant investment. This shift towards digital products and services underscores the evolving nature of global trade and the increasing importance of intangible assets in economic growth.

Hard Landings: 21st Century Hazards

In the 1990s the end of the Cold War and the implementation of NAFTA opened new markets and boosted U.S. trade. Today, the landscape is shaped by factors like the COVID-19 pandemic, completely different trade tensions, technological advancements, and climate change.

Achieving a soft landing today means overcoming several specific headwinds:

- Technological Disruption: AI and automation are reshaping industries, creating efficiencies but also displacing traditional jobs. For instance, automated warehouses have improved logistics for online marketplaces but reduced the need for human labor, leading to job displacement and requiring workers to adapt to new roles in tech and maintenance.

- Geopolitical Tensions: Trade wars and shifting alliances, particularly between the U.S. and China, pose significant risks. The U.S.-China trade war, marked by tariffs and retaliatory measures, has disrupted global supply chains, increased costs for businesses, and created uncertainty in international markets.

- Climate Change and Sustainability: Modern economies must contend with the urgent need to mitigate environmental impacts. Extreme weather events, such as hurricanes and wildfires, disrupt agricultural outputs and trade flows. The push for sustainability drives growth in renewable energy and green tech sectors, exemplified by the increasing adoption of electric vehicles and investments in solar and wind energy.

- Broader Societal Implications: Income inequality, political polarization, and the future of work influenced by technological advancements require significant adjustments in labor markets and education systems. For example, the rise of remote work during the pandemic has permanently changed job dynamics, necessitating new skills and flexible work environments.

Conclusion

The U.S. economy in 2024 looks like a structural success story, with conditions reminiscent of the mid-1990s that allowed for a soft landing. Achieving this required balancing persistent inflation, trade tensions, and climate change disruptions with the growth of digital trade and green technology. The continued emergence of digital trade has improved the complexity and resilience of the U.S. economy.

By fostering a supportive environment for digital trade, enhancing cybersecurity, and investing in sustainable technologies, the U.S. and other advanced economies can navigate these challenges. Embracing these opportunities will bolster economic resilience and pave the way for sustainable growth and prosperity in an increasingly interconnected world.