Securing Supply Chains: The Strategic Role of Rare-Earth Elements

As rare earth elements drive the tech and defense industries, China's dominance poses a significant risk. Can the U.S. develop alternative supply chains to secure these critical resources?

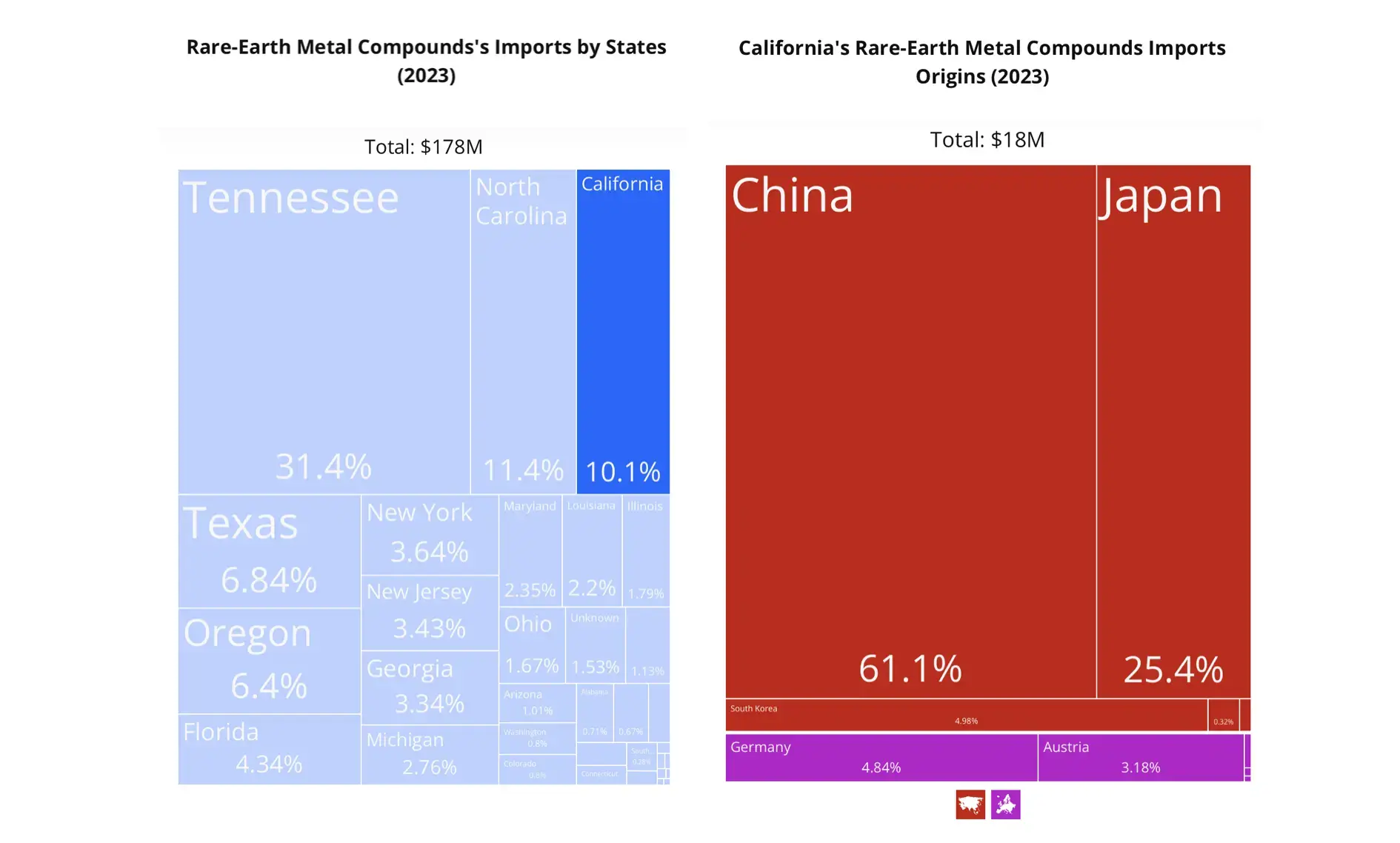

Known as the "Group of 17," rare earth elements are crucial for making powerful magnets, luminescent materials, and other unique chemical properties. These elements are difficult to find in useful concentrations, challenging to mine, and extremely hard to refine and purify. Yet, they are essential to defense, communications, digital networks, and tech industries. If advanced semiconductors are the crude oil of tech growth and innovation, then rare earth elements are the oxygen—without them, vital industries simply shut down. In 2022, global trade in rare earths peaked at $4.27 billion, a 22.7% increase from the previous year. China controls 40% of the global demand for rare metal compounds and supplies 69% of the U.S. demand for scandium and yttrium compounds. China also dominates 58% of global rare-earth mine production and accounts for a fifth of rare-earth exports. In 2023, China exported $764 million worth of rare-earth metals, a 59% decrease from 2022, reflecting a strategic shift to prioritize domestic use. The urgency to develop alternative supply chains has never been greater.

Neodymium and praseodymium are essential for high-temperature magnets in motors and generators, crucial for defense applications. HS code 280530 covers these elements, scandium, and yttrium. Rare-earth compounds (HS codes 284610 and 284690) are used in missile guidance, radar, night vision, fiber optics, nuclear reactors, semiconductor purification, and solid-state lasers.

Not so Fun Facts: Implications of Chinese Dominance in Rare Earth Elements

China began its vision of world dominance of strategic minerals in the 1960s. Even back then Chinese officials called the “group of 17” the “oil of the 21st century.” Finding domestic reserves, painstakingly developing efficient mining technologies and aggressively acquiring significant reserves in Asia and Africa has resulted in a near monopoly in downstream rare-earth manufacturing capacity.

In reports to Congress, the Department of Defense has stressed the critical importance of a dependable supply chain for rare-earth materials. The reliance on China poses serious national security and economic risks. The materials are crucial for the F-35 jet fighters, the AGM-158 JASSM guided missiles, and the MQ-9 Reaper surveillance and tactical drones. Any disruption could severely impede the production of these systems. A 2019 Department of Defense report estimated that a six-month disruption in rare-earth supply could cost the U.S. military around $1.75 billion in delayed and disrupted projects.

The global electronics market, valued at around $1 trillion, also relies heavily on these minerals. Each smartphone contains about 0.15 grams. The renewable energy sector is an eager customer. Each 3 MW wind turbine takes 600 kilograms. Electric vehicle batteries each need 10-15 kilograms. Supply chain disruptions could increase production costs by up to 10% in the electronics industry and 5-7% in the automotive sector.

The United States, with15% of global rare-earth output, processes some rare-earth oxides domestically from a single California mine, but remains heavily reliant on China. In 2024, U.S. imports of scandium and yttrium compounds from China had dropped by -60.4%. Australia and Vietnam have boosted their production capabilities but growth is slow because of the mining and refining challenges in bringing rare earth elements to market. In 2022, Australia exported $162 million worth of scandium and yttrium, positioning itself as an important alternative but still dwarfed by Chinese dominance.

U.S. Efforts to Revive Domestic Production

The Department of Defense (DOD) has allocated $439 million to bolster domestic production. Key projects include upgrading the MP Materials’ Mountain Pass facility in California, the only active rare-earth mine in the U.S. The broader strategy includes improving refining capabilities for heavy rare earths and exploring new technologies like “biomining” for more efficient extraction.

Future Projections for Rare-Earth Element Demand

The global demand for rare-earth elements is projected to grow significantly due to the EV economy. Demand is expected to reach 466 kilotons, up from 170 kilotons in 2022, reflecting an 8% compound annual growth rate (CAGR). The International Energy Agency (IEA) predicts that mineral requirements for clean energy technologies could increase sixfold by 2040.

Electric vehicles (EVs) and wind turbines are major drivers. EVs require six times the mineral inputs of conventional cars, with rare-earth elements essential for EV motors. Onshore wind plants need nine times more mineral resources than gas-fired power plants, with magnetic neodymium and dysprosium critical for turbine generators.

Policy Recommendations for a Secure and Sustainable Supply Chain

Several policy measures are essential to support a secure and sustainable supply chain:

- Investment in Domestic Mining and Processing: Immediate initiation of upstream mining operations is crucial due to long development lead times. An estimated $30 billion is needed from 2022 to 2035.

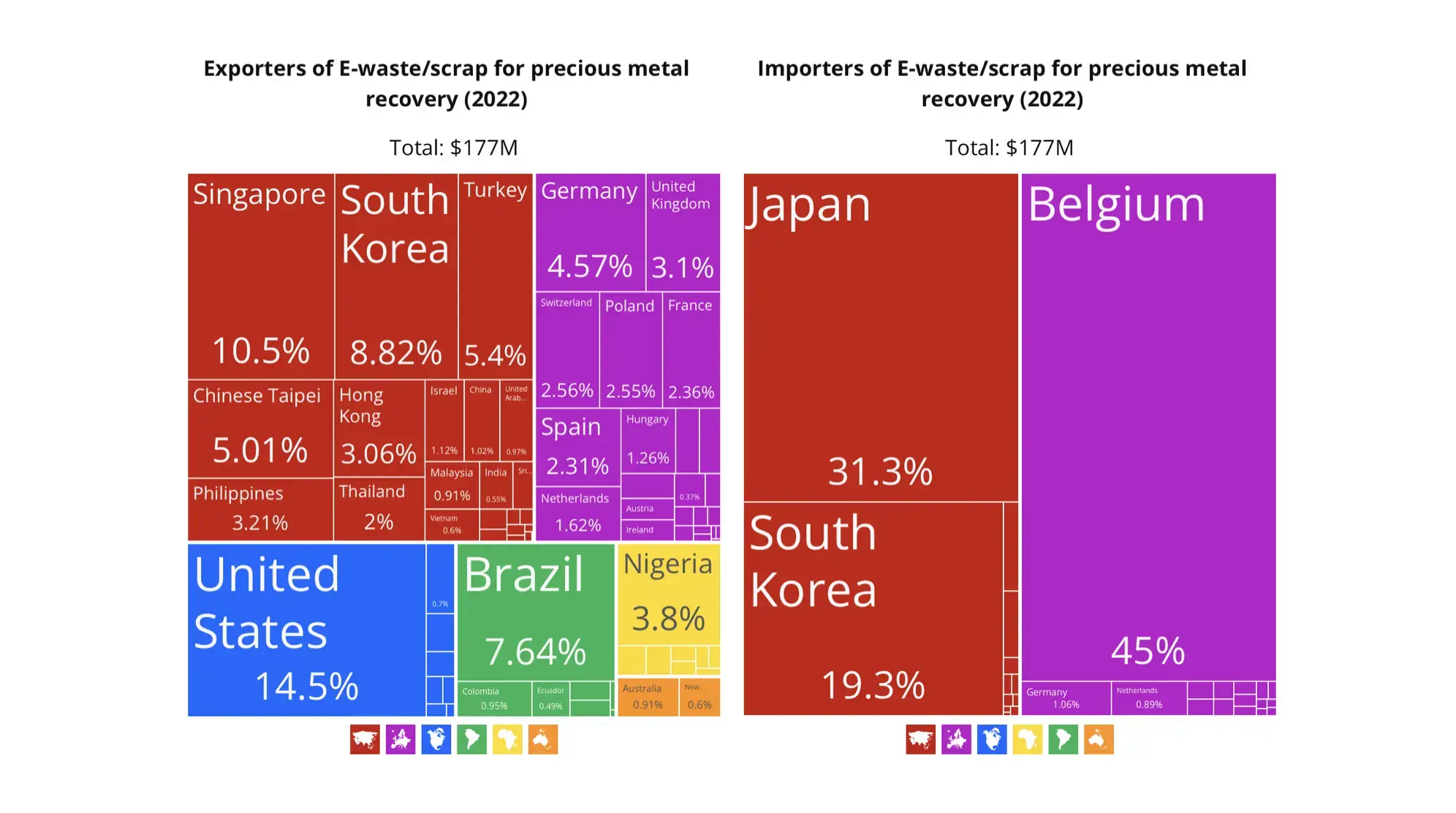

- Enhancing Recycling Infrastructure: Recycling efforts could meet about 30% of future demand for key rare-earth elements. Policies that mandate product designs for easier recycling can help mitigate resource scarcity.

- International Collaboration: Public-private partnerships, regional alliances, and industry consortia can improve supply chain resilience.

- Regulatory and Policy Measures: Governments should establish strategic reserves, streamline mining regulations, and support sustainable mining practices.

Conclusion

Securing a reliable supply of rare-earth elements is crucial for U.S. national security and economic stability. Policymakers and industry leaders will support initiatives that enhance U.S. rare-earth supply chains. Can China’s near monopoly be significantly challenged? That is the biggest question facing US defense and tech industries for the foreseeable future.